What If My House Burns Down And I Don't Want To Rebuild [Best Answer]

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

Important things to do after a house fire:

Find temporary housing

After a house fire, the first thing you need to do is find a safe place to stay amidst the char and scorch of the blaze and the ashes. Dealing with the loss of your home can be a devastating experience, so ensuring your safety and well-being is crucial for your health. As the flames are extinguished and the ember and soot settle, keeping safe from the aftermath is crucial. If you have insurance, your policy may cover the cost of a hotel or other temporary housing, maintaining a sense of quality and structure during this difficult time. Many insurance companies offer location-based assistance to policyholders, helping you find the best place to stay nearby without paying any additional fees. Of course, be sure to check any portion of your policy that discusses temporary accommodations and if there's a dwelling limit.

If you don't have insurance, ask your local Red Cross chapter or other disaster relief organizations for help, which may prove a lifesaver as the wildfire or the inferno leaves its mark on your life. These organizations can answer your questions and guide you through the process of finding a safe place to stay, sometimes even providing payment options for temporary housing. They may also help you manage the difference in available funds, ensuring that you can get back on your feet and find a temporary place to land.

Once you have a place to stay, with the torch of the fire finally out, contact your local building department to find out what permits and inspections are required before you can start rebuilding your charred home, and any local laws that might impact the process. You will also need to contact your utility companies to have service restored to your home, eliminating the remnants of the cinder-filled scene. Additionally, check with local authorities about safety guidelines for building materials to ensure a secure rebuilding process and the potential benefits for using specific materials. Compliance with local regulations is crucial to avoid any issues during the rebuilding of your home and any potential endorsements for using specific materials in buildings.

Call your insurance agent

Your agent or attorney will be able to help you determine what kind of coverage you have and what steps you need to take next. They may also be able to give you an estimate of how much it will cost to repair, incinerate, or replace your home and possessions. In addition, your agent can help you file an insurance claim, navigate the complicated claims process for insurers, and provide proof of damages to cover your losses.

If you don't have homeowners insurance, now is the time to get it, as a good policy can help you recover from a fire, flood, or another disaster. Be sure to document all the damage to your home with photos or video so you can provide evidence to insurance companies, avoiding the troublesome sign of a contentious dispute. And remember, anything you can document will bolster your claims, making the process smoother.

What to consider when rebuilding your home?

Additional damage

One of the most important factors is additional damage that may have been inflicted during the disaster, such as fumes from smoldering combustion. For example, if your home has been flooded, there is a risk of mold and mildew growth. If it has been damaged by a major fire, there is a risk of smoke and fumes.

As a result, it is important to have a qualified inspector assess the damage and examine the condition of your property before you begin the rebuilding process.

Practical living impacts

How will rebuilding your home impact your day-to-day life? If you have young children, for example, you may need to be close to schools and other childcare facilities.

Or if you rely on public transportation, you'll want to make sure that your new home is located in an accessible area.

Costs to consider

When rebuilding your family home, there are a lot of costs to consider that you may not have thought of at first. One cost is property taxes, which could constitute a significant percentage of your overall expenses. This financial obligation, like the price of various building materials or the payout received from insurance companies, varies among buyers and sellers of properties.

Depending on the value of your home, your property taxes could go up substantially. Another cost to consider is the cost of materials, such as the various items and contents needed for the construction process. These prices can fluctuate, and both the buyer and seller may need to exercise their expertise in acquiring the necessary items at reasonable prices.

Depending on the size of your home, you might need to buy more building materials than you originally thought. The cost of labor and professionals' interest in taking up the project is also something to consider at this point in the rebuilding process.

If you hire a contractor, they will charge you for their time and materials. You will also need to account for documentation and permits, which may require your attention. You will need to get a permit from your city or county under your name in order to rebuild your home.

All of these costs can add up quickly, so it is important to take everything into account and be prepared before you start rebuilding your home. Proper financial planning can lead to better decisions and improvements in your rebuilding project.

Deciding on dwelling coverage

Replacement Cost Value (RCV)

Replacement cost reimburses you for the cost of repairs or replacement, up to the policy limits. The main advantage of RCV coverage is that it takes into account the current cost (market value) of materials and labor, so you won't have to worry about being underinsured if prices have gone up since you purchased your policy. This is particularly important for people in the construction industry, where costs can fluctuate. In this way, RCV coverage protects your investment and reduces property loss in the event of significant changes to building requirements or market conditions.

In addition, RCV coverage typically includes protection against inflation, so your dwelling coverage will automatically increase over time to keep pace with the rising cost of repairs. This can provide peace of mind for homeowners and the staff responsible for maintaining the property, as it ensures that the roof over your heads remains insured at an appropriate level.

However, one downside of RCV coverage is that it may be more expensive than other types of dwelling coverage.

As always, be sure to speak with your insurance carrier to determine which type of dwelling coverage is right for you.

Actual Cash Value (ACV)

ACV [1] policies will reimburse you for the cost of repairs minus depreciation, so if your home is destroyed you may not receive enough money to rebuild it from scratch. In such cases, a public adjuster and their team can help you navigate the complexities of these policies.

However, ACV policies are often cheaper than replacement cost policies, so they may be a good choice if you're on a tight budget.

Ultimately, the decision of whether to choose an ACV or replacement cost policy depends on your individual circumstances and needs. After a thorough cleaning of your garage and belongings, you can begin the rebuilding process with the help of contractors, adjusters, and others, who will establish a list of necessary repairs and coordinate with your insurer. They'll also manage resources like the replacement of appliances and help organize any receipts or relevant documents, such as those pertaining to your homeowner's policy. This plan can ensure that you and your neighbors are well-informed about the rebuilding process.

In the meantime, your insurer will likely provide coverage for temporary housing and debris removal as you navigate through the complexities of the rebuilding process. Property owners should be aware of the different types of coverage, such as replacement cost coverage, available to them in their policy's declaration form. Checking your insurer's FAQ section might provide some valuable information on the material aspects of your coverage.

The insurance industry is notoriously slow in settling claims, and it's not uncommon for it to take months or even years to reach a final resolution. In the meantime, you'll likely need to find another place to live or manage your mortgage.

The good news is that most insurance policies will cover the cost of temporary housing. As for the actual insurance settlement, it will depend on a number of factors, including the extent of the damage and the cause of the fire.

Will I be able to get my full replacement costs if I buy instead of rebuilding?

A guaranteed replacement cost policy will cover the full cost of rebuilding your home, no matter how much it may have increased since you originally bought it.

On the other hand, a replacement cost policy will only cover the cost of rebuilding your home up to the amount specified in the policy.

So if building costs have gone up since you purchased your insurance policy, you may have to pay some out-of-pocket expenses. However, both types of policies should cover any debris removal and temporary living expenses that you incur after a disaster.

Key Takeaways

The insurance industry is notoriously slow in settling claims, and it's not uncommon for it to take months or even years to reach a final resolution. In the meantime, you'll likely need to find another place to live.

The good news is that most insurance policies will cover the cost of temporary housing. As for the actual insurance settlement, it will depend on a number of factors, including the extent of the damage and the cause of the fire.

If the fire was caused by negligence on your part, such as leaving candles unattended, your settlement may be reduced or denied altogether. However, if the fire was caused by an external factor, such as faulty wiring, you should be eligible for full coverage.

Ultimately, it's important to work closely with your insurance company to ensure that you receive a fair settlement.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

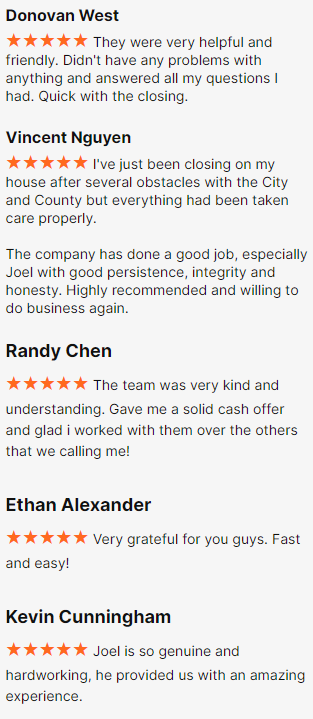

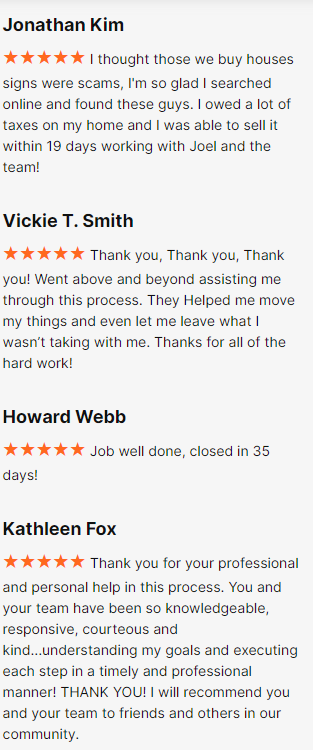

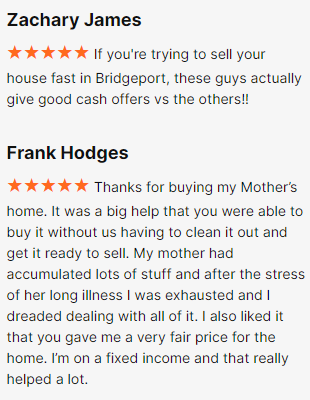

Happy Customers

All Rights Reserved | Fire Cash Buyers