Can You Get A Mortgage On A House With A Bad Roof?

We Buy Houses With Bad Roof

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

Buying a house is stressful. It's even more stressful if there are problems with the house - like a bad roof. Even with a "bad roof," you can still get a mortgage for your dream home; it might just be more challenging.

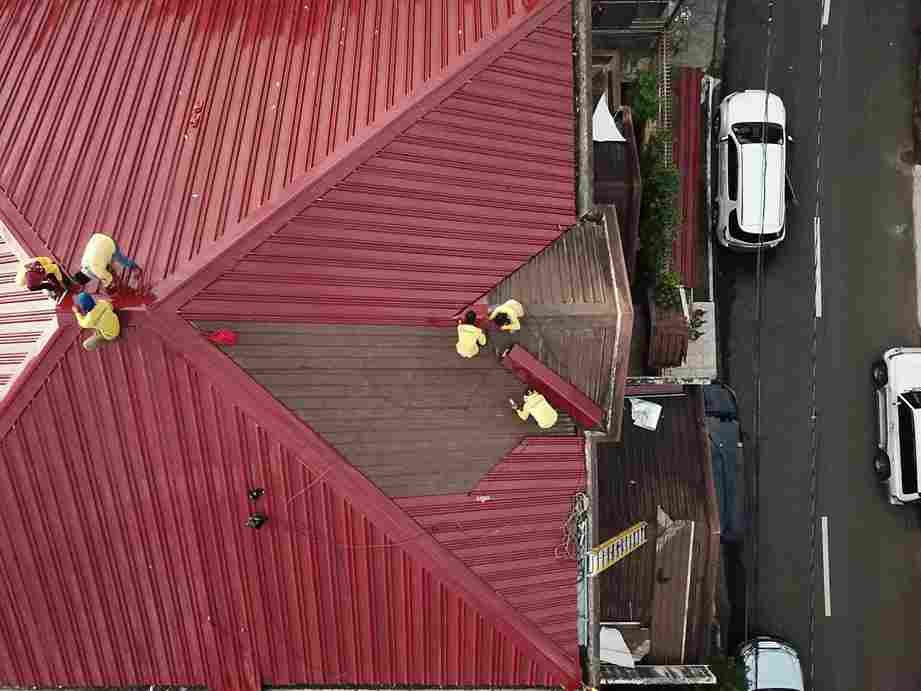

What Exactly is a Bad Roof?

Your real estate agent and home inspector will tell you that a bad roof can cause significant problems for your home's insulation, water infiltration, and overall stability, and they're right.

A bad roof can lead to many problems, including water damage, insulation problems, and even structural damage. It's essential to have a roof inspected every few years to ensure it's in good shape, and if it's not, to get it repaired as soon as possible.

Will a Seller Pay for Roof Repairs on the House?

A leaky roof, old roof, or a roof sheathing that is missing on a home; will make you want to pay extra attention at your home inspection during your inspection period. If it's determined a roof repair or replacement is necessary on your dream house, you can contact a local builder for a free estimate on repair costs for bad roofs.

It is possible that a seller will pay for these repairs or pay for some of your closing costs to sweeten the deal, so to speak, and ensure you have enough cash to close on time. Sellers want to sell their homes and know the risk of walking away from a deal with a buyer willing to purchase a house that needs a new roof.

Can You Qualify for a Mortgage with a Bad Roof

If you're thinking of qualifying for a mortgage with a bad roof, don't let fear stop you. A bad roof can be fixed, and it's essential to get it repaired in a timely manner if it's causing water damage or leaks. A roof repair can cost anywhere from $3,000 to $10,000, depending on the severity of the damage and if the home needs a new roof.

If the roof is in poor condition with further damage to electrical wires, insulation, structural components, and other issues from the roof damage, a lender might not write a mortgage on the property. In this case, you would either need to pay cash for the purchase price or try to secure a new loan.

Also, keep in mind that you will need to be able to ensure the home after your purchase through a homeowners insurance company to satisfy the requirements of many lenders.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

How to Finance a House with a Bad Roof

Financing a house with a bad roof can be a difficult task for homebuyers, but with the help of trusted mortgage companies, it can be done. As mentioned before, repairs can cost a lot of money, but if you have a good credit score and a good income, your best bet is to get a rehabilitation mortgage or FHA loan (Federal Housing Administration)called a 203K loan that covers the costs of roof issues allowing you to buy the home as is.

Working with a local mortgage company that specializes in these loans will save money, time, and frustration on your part. Make sure that you reach out to a trusted and experienced local agent to guide you through the process as you find your dream home.

We Buy Houses With Bad Roof

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

Happy Customers

All Rights Reserved | Fire Cash Buyers