Can You Get A Mortgage On A House With Foundation Problems

Deciding whether or not to purchase a home is one of the most significant decisions you will make in your life, even when the house is in move-in ready, perfect condition. But, what if that house you are looking to buy is in less than a perfect condition - what then?

Buying a house with foundation issues or in need of foundation repairs can cause problems. Getting a detailed home inspection to ensure your potential new home is structurally sound makes sense, but is that enough to secure a final mortgage approval from your lender?

Conventional mortgages can be tricky to obtain if your dream home doesn’t pass a structural engineer’s report, but not all foundation issues will disqualify you from getting a loan.

Throughout the course of this article, we will discuss what various foundation issues mean for you and purchasing your dream home and how to put yourself in a good position to get a loan from your lender with foundation issues.

What are the Signs of a Home with Foundation Issues?

Living in and walking through a house with foundation problems is, generally speaking, safe to do. Just because a home has foundation issues does not mean that there is major structural damage or the overall structural soundness of the home is in jeopardy.

Common signs of foundation damage can be in the form of minor cracks, small leaks in the foundation during storms, or small cracks in the walls of the home. More likely than not, when you’re looking to buy a house, your local agent will point out these signs of damage long before an inspection.

If the property is facing major foundation issues that could lead to significant problems down the road, your agent might suggest that you look at other houses during your home search or offer a lower price when making a final offer on the home.

Be aware that all mortgages and loans are subject to final approval after an inspection and that foundation issues could be a deal breaker for many lenders.

What Kind of Foundation Problems Will Cause Issues with Mortgages?

If your dream house has a foundation, your home inspector will take a look at it during your option period. The bottom line is that most lenders can’t overlook foundations that require major repairs due to the extent of foundation damage and secondary issues the home’s foundation will cause, such as uneven floors, cracking walls, and structural integrity.

Some of the major issues that could disqualify your dream home from a conventional mortgage include:

- Major or large cracks

- Drainage issues

- Shifting or Sinking

- Bulging of exterior walls

- Crumbling or erosion due to drainage issues

If your potential home has any of these signs of foundation damage, it could be a deal breaker, especially for those with limited cash funds.

Options for Mortgages Other than Conventional Mortgages

As mentioned before, getting a conventional mortgage on a home that needs major foundation repairs can cause some significant financing issues. If you want to be able to close properly on your dream home with a failed foundation inspection, there are a few different types of rehabilitation loans you could try.

- Fannie Mae - A Fannie Mae home-style renovation mortgage might be a solution for your financing issues. These loans are designed to help you purchase a home with problems like potential foundation issues and have money after the closing to make the needed repairs by a qualified local foundation repair company. Some of the key benefits include lower closing costs and fewer mandatory fees throughout the loan. However, the interest rate will be higher than on a standard loan, and your minimum credit score will need to be at least 620.

- A Government Backed Loan - A good example of a government loan will be an FHA 203K Loan. These loans are backed by the federal housing administration and are great for homes that need a lot of repair work and are also known by the name mortgage rehabilitation loan, renovation loan, or Section 203(k) loan. These loans are great for buyers with low credit (as low as 500) and who want to occupy the home they are renovating. A major drawback is the super high closing costs and fees.

These are just two of the examples of loans you can look into when your dream home needs major repair work done to the foundation. Also be sure that you have enough saved for the down payment of each of these loan types before applying.

Of course, if you’re a Veteran, contact the office of Veterans Affairs to see if they offer any loans in your area for homes in need of repair and if you qualify to apply.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

The Cost Of Foundation Repairs

There’s no way around it - major foundation repairs cost a significant amount of money. Foundation problems and their associated repair costs can vary depending on how bad the issues are, where they are located on your foundation and where you live.

Speaking with local agents to get recommendations on foundation repair specialists is a good first step. Generally, foundation repairs can be broken down into the below costs.

- Vertical Cracking - $200 - $800

- Horizontal Cracking - $3,000 -$4,000

- Leaks - $2,000 - $10,000

- Bowing of Walls - up to $15,000

- Crumbling and Erosion - up to $15,000

With these high costs for repairs to a house, it's always wise to ask the seller to try and include repairs and their costs into their closing costs. Your real estate agent will advise you on what is best for your situation and the type of mortgage loan you have applied for.

No matter what you do, end up deciding to do mortgage-wise for purchasing your dream home with foundation issues - know that it is possible! For more information on purchasing or

selling homes with problems, please check out our blog.

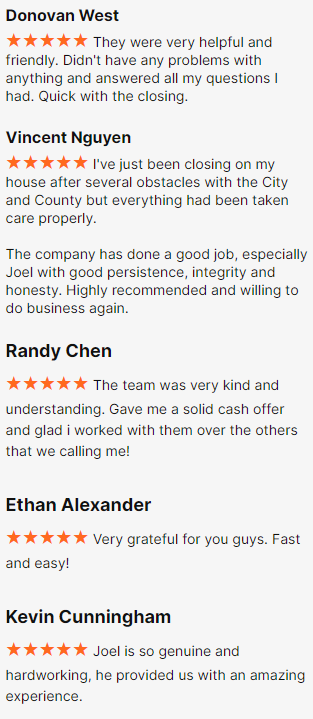

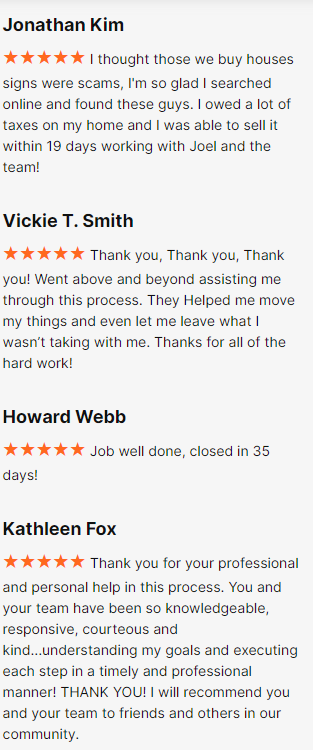

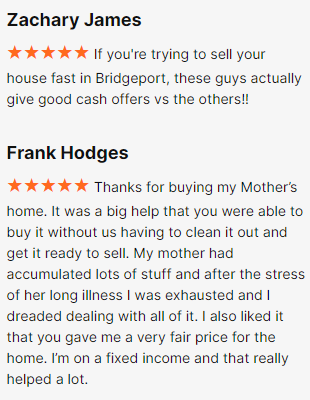

Happy Customers