Can You Get A Mortgage On A House With Structural Damage

We Buy Houses With Structural Damage

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

With ever-changing market conditions and the rise and fall of housing demand, getting a mortgage approval can be demanding for some buyers. Conventional mortgages, rehabilitation loans, and loans from the federal housing administration or FHA might all seem to blend together and are hard to differentiate for many.

If you are looking at purchasing a home that has structural damage, needs foundation repair work, or has other issues with the overall structural integrity of the home, what home loan is right for you?

Homes for sale that are in need of structural repairs of any kind can present financing issues due to those repairs. In some cases, these homes will only qualify for what is called rehab loans after a deep review by a structural engineer or appraiser looking at the overall structural soundness of the property. These damages will also damage the projected value of a home.

Follow along as we dive into what structural damage in a home can mean for you, what common repair costs could be, and what mortgage options might be available to you.

What are the Various Types of Structural Damage?

If you are early in your home search, something you should educate yourself on is what structural damage in a home looks like. It makes sense to be aware of these issues before you get too invested in purchasing the home.

Some obvious signs of structural damage or homes that need structural repair include:

- Cracking or Bulging on Walls and Ceilings: Keep in mind that not every crack in a wall or ceiling means that there are underlying structural damage or foundation cracks. Over time, tiny cracks can turn into something more problematic and indicate bigger issues.

- Chimney Cracks: Cracks in your chimney are a sign that your potential house is moving and is placing undue pressure on the bricks.

- Gaps around Windows and Doors: You can notice these issues without a home inspection. These signs manifest in pretty obvious ways, including gaps around the door frame, doors and windows that don't open or close properly, doors or windows that are separating from the wall, and doors that won't stay closed all the way.

- Damp Subfloor or Crawl Space: A damp crawl space or subfloor can be a bigger indication of issues. Typically a home inspector will check these areas for potential foundation damage, including a cracked foundation or drainage issues.

If you see signs of any of the above-mentioned types of potential structural damage in a home, be sure to consult with a local professional before moving forward with the home purchase - even if you are prepared to buy a "fixer upper" style home. These seemingly small problems can lead to major repairs in the future and turn your dream home into a nightmare home.

Counting the Costs - How Much can Repairs, Including Foundation Repairs Cost?

If you're a buyer working on a budget with limited cash, counting the cost of repairs before purchasing a home is essential. In addition to your down payment, cost of a home inspection, closing costs, and hiring movers, you also need to factor potential repairs into your budget and the final purchase price of the home unless you're fortunate enough to be able to pay cash.

Common repair costs start at $5,00 and can go well above $10,000 for more advanced repairs, including major foundation repairs, and in most cases, can cost much more.

Loan Options that are Available to You

Don't feel trapped! If the home you're looking at purchasing needs a lot of work and won't qualify for a conventional loan, there are options. Many mortgage lenders offer rehab loans, government-backed loan options, and other loans that will align with the current value of the home without being structurally sound. Some of these loan options include:

FHA 203 K Mortgages: Offered through the federal housing administration, these 203 K mortgages can be used to fund structural repairs with extra money provided to the buyer at closing. The 203 K loan offers buyers a single loan that covers the purchase of the property, repairs, and improvements that need to be made, and other costs associated with the repairs.

Fannie Mae Homestyle Renovation Loans: A secondary option is to work with Fannie Mae if your home has foundation problems for a rehabilitation loan. Fannie Mae works with a lot of approved lenders to offer buyers fixed-rate 15 and thirty-year mortgages or a second mortgage, making it more accessible to attain your goal of homeownership. These mortgages are also great for urban development.

Most lenders will be able to find at least one loan that you can qualify for if your home has signs of foundation damage or large cracks. Speaking with a local lender will give you a better idea of what loans are common in your area and what the subject property will be able to qualify for.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

Final Thoughts

Working with a trusted lender and real estate agent is the first step in making a sound financial decision with your hard-earned money. A house that needs repair work can be a good option for you to secure a low asking price on a home and build value over many years to come as you enjoy life in your dream home after repairs are made.

For more information on purchasing or selling a home that needs major repairs, check out our blog.

We Buy Houses With Structural Damage

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

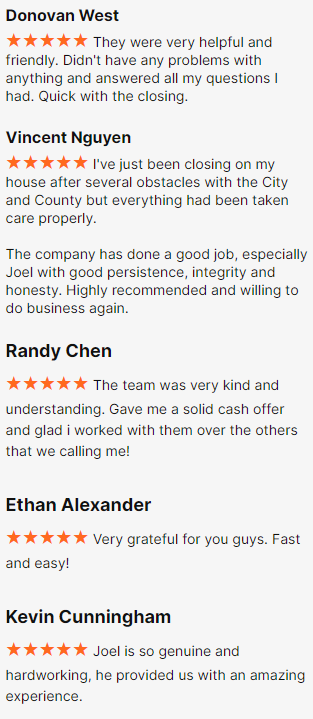

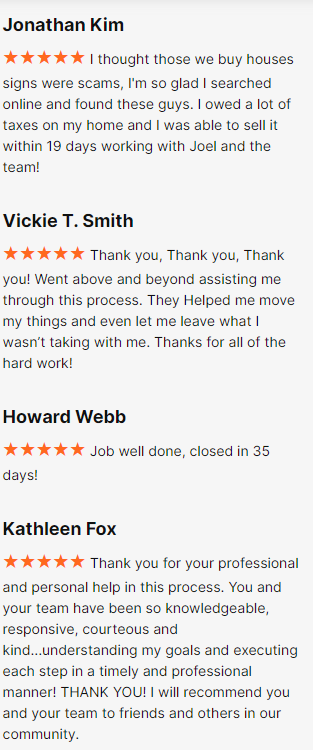

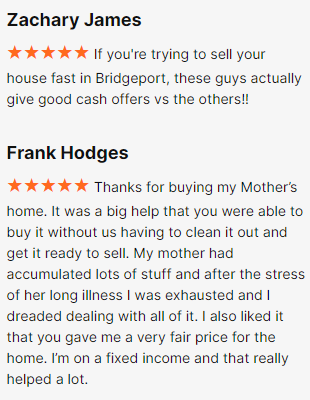

Happy Customers

All Rights Reserved | Fire Cash Buyers