Do You Have To Disclose Flooding When Selling A House

We Buy Flood Damaged House

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

When you go to sell your house, your real estate agent will have you fill out form after form, including a property disclosure. This property disclosure form lets a potential buyer see what kinds of damage or problems your house may have.

State and local laws dictate what needs to be disclosed and vary from state to state.

Does the Federal Government Require Disclosure of Flooding and Flood Risk/Flood Zone?

No, you don't have to disclose flooding risks to any home buyers due to rules and regulations from FEMA or the Federal emergency management agency.

In general, the federal government does not require disclosure of risks for flooding, even if your property is in a flood zone or has experienced previous flood damage from a house flood. However, there are some exceptions. For example:

Suppose you're selling a single-family home and trying to get financing from a federally insured lender (like Fannie Mae). In that case, these lenders may require that you provide them with evidence that you have disclosed all known defects on your property (including if the house flooded or has any flood history) and correct those problems by repairing or replacing damaged parts of the building before selling it.

Do Sellers Have to Notify Buyers of Flooding?

The answer to this question is, unfortunately, a little bit complicated. It all depends on which state you’re selling in and what kind of home you’re selling.

In general, there are two ways people can be held liable for not disclosing flooding risk. First, some states require sellers to disclose flood risk if they know about it (like California).

Second, even if your state doesn't require you to disclose the risk yourself, the buyer can still sue you—and win—for not telling them about the danger.

Can You Be Liable for a Property's Flood Risk as a Seller?

There are a few circumstances where you can avoid liability for not disclosing that your house was flooded. In most situations, however, ignorance will not absolve you from responsibility.

If you never knew about a flood in your home, then you're probably safe from lawsuits if the buyer later sues over damages caused by flooding.

You should still disclose this information to potential buyers, even if it affects the property value in most real estate transactions.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

States that Have Flood Disclosure Requirements in State Law

As mentioned, prior disclosure laws vary from state to state during a real estate transaction for home sellers. Prospective buyers do well to educate themselves on local flood maps and the potential for future flooding and a home's flood risk before purchase, regardless of the disclosure laws.

States that require real estate agents and sellers to disclose past flooding and a property's flood history including:

- Mississippi

- Oklahoma

- Louisiana

- Texas

- South Carolina

For a complete list of where homeowners will need to disclose a property's history of flooding check out this link.

Make note that many states have robust laws with Texas law being the strongest that requires sellers to disclose numerous reports regarding flooding and if a home has experienced flooding.

Again disclosure laws vary from state to state. Always check with a real estate attorney or real estate agent for a full list of flood disclosure laws in your area.

We Buy Flood Damaged House

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

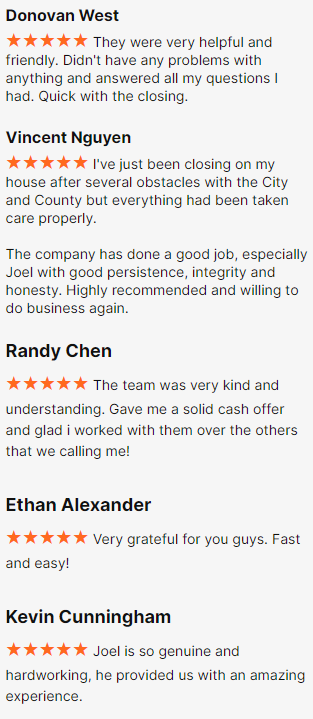

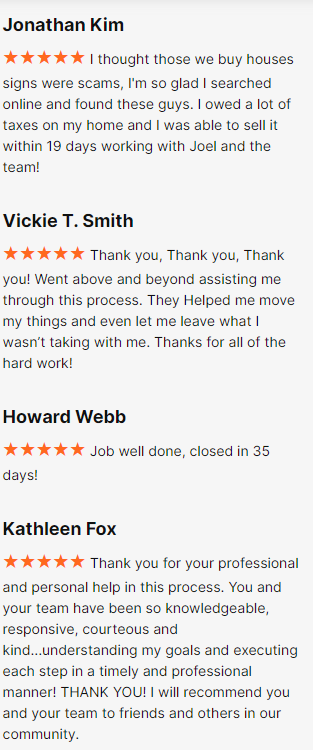

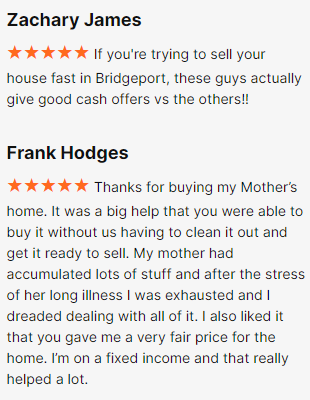

Happy Customers

All Rights Reserved | Fire Cash Buyers