Fire Department Damaged My Property [What You Need To Know]

If firefighters, damage your property while fighting a fire, employ equipment such as ladders, tools, and water, you may be able to file a claim against the local fire department. In some cases, the fire department may be liable for damages even if the fire was not their fault, as long as they were acting within the scope of their employment. Before taking any action, it's crucial to consult with a lawyer and seek their advice on your claims and rights. The landlord or owner of your residence may also be held responsible for repairs, depending on the circumstances. It's essential to address issues such as these, especially if firefighters, clad in their suits, break down doors and windows, or put holes in walls using a ladder to access the fire, as it is best to have a list of damage to provide to the authorities. You will need to file a claim with the appropriate government office, provide evidence of the damage, and note the firefighters involved if possible. Taking care of these matters will be important to maintain a good relationship with the fire department. If the fire department denies your claim, you may need to hire a lawyer to help you get compensation for your deductible damages. Make sure to have their contact number readily available.

What To Do if The Fire Department Damages Your Property

If the firefighters damage your home while fighting a fire, you may be entitled to claim the town, city, or county that employs the firefighters and ultimately pays for their services.

Under the law of most states, a firefighter who damages property while fighting a fire is not liable for that damage unless they act in a grossly negligent or reckless manner. This rule is based partly on public policy: we don't want firefighters, wearing their protective suits, to fear legal consequences and become timid when lives and property are at stake. But there's another reason firefighters are generally not liable for the damage they cause: local governments (municipalities) can almost always be held legally responsible for their employees' conduct as long as they were acting within the scope of their employment during a fire. Sometimes they'll want you to demo your house but that's another story.

When an Insurance Company Covers Property Damage

If you have homeowners insurance, your insurance policy should cover fire damage to your home and personal belongings, even if the fire was started by lightning, arson, or other excluded events such as the damage the fire department does. Contact your insurer right away to file a fire insurance claim. If you live in an area where there are many fires each year, check with your insurance agent to make sure you're adequately insured. It's also a good idea to photograph or videotape your property and possessions.

How Do You Get in Touch With The Right People?

If a fire department damages your home or property, find out who is responsible for the damage. Suppose the damage was caused by negligence from firefighters or other emergency services providers. In that case, you may be entitled to compensation from the city or county where the fire department is located.

You can file a claim against a city or county if they have provided services and have damaged fire caused to your property. You can file this claim through the city's risk management office.

What to Expect During The Process

- You will need to fill out a damage claim form.

- You will review the claim, and you may contact me for more information.

- If the claim is accepted, you will be given a settlement amount.

- If the claim is denied, you can appeal the decision.

How to File a Claim Against The Fire Department

1. Locate the appropriate office to file your claim. For example, the municipal or county government office will oversee the fire department in most cases. You may need to find the address for this office online.

2. Complete the required claim form. This form will ask for information about the damage, including when and where it occurred.

3. Submit evidence of the damage. It may include photographs, video footage, or receipts for repair costs.

4. Wait for a response from the government office. The government may ask you to provide more information, or they may deny your claim outright. If your claim is denied, you may need to hire an attorney to help you get compensation for your deductible damages.

What To Do If You're Denied Compensation

1. Appeal the decision. If you believe that your claim was wrongly denied, you can appeal the decision. It will require filing a written appeal and providing additional evidence to support your case.

2. Hire a lawyer. If the government denies your claim and you cannot get it overturned, you may need to hire an attorney to help you get compensation for your deductible damages.

Homeowner's insurance is often used to cover first-party losses. This means damage that only involves you, the property owner. For example, if your roof is damaged in a storm, that would be a first-party claim. Check with your insurance agent to ensure you're adequately insured and keep their contact number handy. It's crucial to have this information readily available, so you can quickly give notice if you ever need to file a claim in court.

Do You Get Charged If The Fire Department Comes To Your House?

Fire departments typically aren't responsible for property damage while trying to put out fires or responding to emergencies. It is because firefighters are often under pressure during these situations, and they don't have time to worry about causing damage to someone else's property. Therefore, your liability insurance will likely cover any damages caused by the firefighters, not the fire department. If you have homeowners insurance, your insurance policy should cover fire damage to your home and personal belongings, even if the fire was started by lightning, arson, or other excluded events such as the damage the fire department does while using a hose to put out the fire. This coverage provides a great way to save money and protect your assets. Contact your insurer right away to file a fire insurance claim and verify the terms of your lease if necessary.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

Who is Responsible For Accidental Damage to Property During Rescue Efforts?

The organization or individual responsible for the accidental damage to property during rescue efforts is typically the party liable for the damages. For example, if a rescue crew damages a homeowner's property while attempting to save it from a fire, the crew would be liable for the damages. If a neighbor's property is damaged while firefighters extinguish a blaze next door, the neighbor may file a claim against the city or town government.

Does The Fire Department Bill You?

Fire departments typically aren't responsible for property damages while trying to put out fires or responding to emergencies. It is because firefighters are often under pressure during these situations, and they don't have time to worry about causing damage to someone else's property. Therefore, your liability insurance will likely cover any damages caused by the firefighters, not the fire department.

Does Your Insurance Company Cover Fire Department Charges?

Most homeowners' insurance policies cover costs incurred by the fire departments in fighting a fire on the insured property.

Considering To Sell The Property Damaged By Fire Department

Experiencing a fire department's response to a fire in your property can leave you grappling with the aftermath of both the fire and the damages caused by their efforts to extinguish it. If you find yourself in this situation, it's essential to assess your options, avoiding pitfalls when selling a fire damaged house.

Get the best deal: Selling a house damaged by fire may be a viable solution to alleviate the burden of repairs and recovery. By connecting with specialized buyers who understand the unique challenges of fire-damaged properties, you can streamline the selling process and ensure a fair valuation for your home. Selling the property damaged by the fire department can be a strategic decision, providing you with the opportunity to move forward and find a new place to call home, unencumbered by the weight of fire-related damage.

Avoiding pitfalls when selling a fire damaged house becomes possible with the assistance of experienced buyers who can guide you through the process and help you make informed decisions for your property's future.

The Fire Department Broke My Door Down to Fight a Fire. Who Is Responsible For Paying to Repair The Door?

The short answer is that you are. When firefighters break down doors, windows, and walls to gain access, they're not responsible for the damage. The rules vary by state, so check with your local fire officials to be sure. If a fire breaks out in your home, the response will likely include forcible entry unless you can provide the firefighters with the keys or other easy means of access.

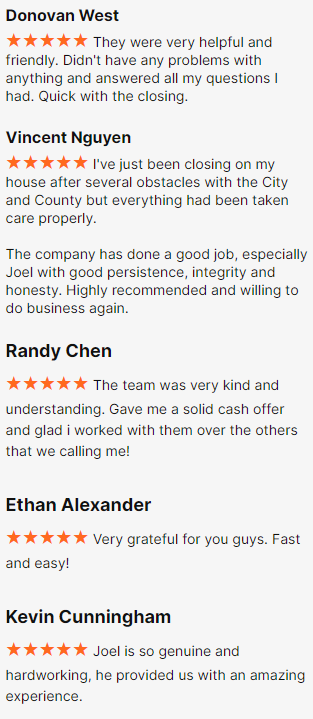

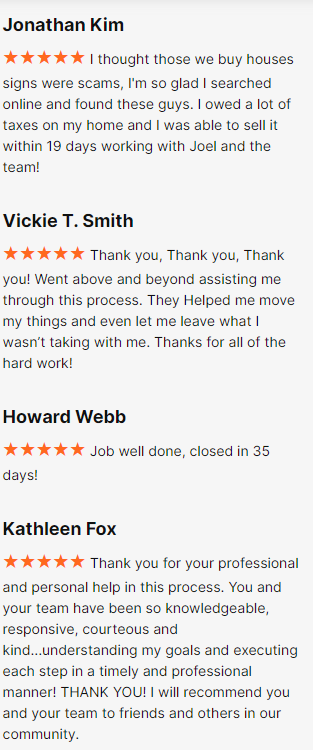

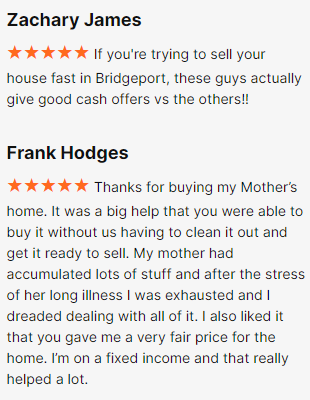

Happy Customers