Neighbor's House Fire Damaged My House: Who's Liable

Who has the right to be held liable if a neighbor's house - or even an apartment building - catches on fire and damages your house? This question is not as easy to answer as one might think, as the circumstances vary in every case. Many factors contribute to a person's liability in such a situation, including state law, the proximity of the residences, and the structure of the buildings. Additionally, whether the person affected is a renter or a homeowner may also play a role. In some states, the party whose negligence caused the fire may be held liable for damage to neighboring properties, including both the building structure and the contents inside, as well as injury or harm to individuals. However, homeowners insurance policies often cover damage caused by a fire, even if the homeowner did not start it.

Selling a fire-damaged house can also be a viable option to recover financially and move forward. To get top dollar for your fire-damaged house, it's essential to showcase its potential and highlight any repairs or restoration work that has been undertaken. Working with a knowledgeable real estate agent who specializes in fire-damaged properties can help you position your house in the market effectively. They can assist in determining the fair market value and implementing a strategic marketing plan to attract potential buyers who are interested in purchasing fire-damaged properties.

Remember, with the right approach and professional support, you can protect your rights and get top dollar for your fire-damaged house. Whether through an insurance claim or a successful sale, explore your options and make informed decisions to maximize your financial recovery."

What Is The Law In This Situation?

The law regarding this situation varies by state. In some states, the party whose negligence caused the fire is liable for damage to neighboring properties. However, the homeowner's insurance policy will cover the costs in other states even if the homeowner did not start the fire. You should check with an attorney, such as a homeowner or someone specializing in property rights, in your state to learn more about the specific law in your area.

Neighbor's Liability For Damages Caused By Fire

In general, the neighbor whose negligence caused the fire is liable for damage to neighboring properties. It is true regardless of whether the neighbor used faulty equipment, failed to take appropriate safety precautions, or started the fire deliberately. In some states, this liability is limited to the value of the property damaged by a fire. However, in other states, the neighbor may be liable for any damages, including those resulting from smoke damage or loss of use of the property.

Homeowner's Insurance Coverage For Fires

Most homeowners and renter's insurance policies will cover damage caused by a fire, even if the policyholder did not start it. The policy will usually also cover damage caused by smoke and soot from a neighboring fire. However, there may be a limit to the amount of coverage available for such damages. It is essential to carefully review your own insurance policy to determine what is covered in case of a fire.

Liability And What You Can Do

If a fire damages your home, you need to call your homeowner's coverage provider. Be honest with them about what happened, and don't embellish the story. You'll need to speak with your homeowner's insurance agent, who can give you advice on what to do. A homeowner's insurance company will usually compensate you for damages and then go after the negligent neighbor's insurance provider to recover the losses. It depends on who is responsible for the initial fire.

Who Will Compensate Me If My Neighbor's Fire Spreads To My House?

If the neighbor's home catches fire and spreads to your house, your homeowner's or renter's fire insurance policy will cover the damage. However, your insurer could try to sue the neighbor if they were negligent and caused the accident. Fire investigators help you determine who was responsible for causing a fire and who may be liable. In most cases, fires are caused by one of these things:

- Arson

- Accidental fires

- Careless smoking

- Faulty electrical wiring

How To File Insurance Claims For Fire Damage From Neighbor Fire

If your home has been damaged due to a fire started by your neighbor, you will need to file an insurance claim with your homeowners or renter's insurance company.Your insurance carrier will investigate the cause of the fire and may work with the neighbor's insurance company to apportion blame and liability. You should retain a lawyer with experience in these types of claims to help you navigate the complex legal and medical aspects of this situation. This attorney-client relationship will assist you in negotiating with your insurance company and pursuing a claim against your neighbor if appropriate, especially if the damages extend to a townhouse or condo.

1. Gather documentation of the damage caused by the fire. It should include pictures of the damage, debris, and receipts for any repairs or replacements that have been made. Additionally, you may want to compile records of any medical expenses incurred from the incident.

2. Contact your insurance company and report the fire. Be prepared to provide information about the cause of the fire and how it started. You can also share any funds, money, or resources that were utilized to help cover the damages.

3. Work with your insurance company and the neighbor's insurer to determine who is responsible for the damages caused by the fire. It may involve negotiating a settlement or going to court.

4. Pursue a claim against your neighbor if you believe they are responsible for the damages caused by the fire. Your

attorney or hired law firm can help you negotiate a settlement if necessary.

Homeowner's insurance is often used to cover first-party losses. It means damages that only involve you, the property owner. For example, if your roof is damaged in a storm, that would be a first-party claim.

Is Damage To A Neighbor's Property Covered By Home Insurance?

Yes, your home insurance policy includes coverage for both your personal belongings and your neighbors in the event of a fire. Fire insurance policies typically have a personal liability clause covering damage to your neighbor's property if you were not responsible for starting the fire.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

Considering A Cash Offer For A Fire Damaged House

The unfortunate event of a neighbor's house fire damaging your property can be distressing, but it may lead you to consider a cash offer for your fire damaged house. In such situations, it becomes crucial to explore

effective strategies for selling a fire damaged house and

maximizing the value of your property post-fire damage. Conduct a comprehensive assessment of the extent of the damage and enlist the expertise of reputable fire damage restoration professionals to restore and enhance the house's features. Emphasize the property's potential and unique selling points to attract potential buyers and increase the likelihood of receiving

top dollar for your fire damaged house. By approaching the sale with diligence and highlighting the property's value, you can navigate this challenging situation and secure the best possible outcome.

Can You Sue A Neighbor For Fire Damage

If your house caught on fire due to your neighbor's negligence, then you can sue them to recover your expenses. Keep in mind lawsuits can take several years of negotiation and litigation.

Who is liable if your neighbor's house catches on fire and damages your house? It is a question that many people have, and unfortunately, there is no easy answer. The homeowner's insurance will cover the damages in most cases, but it's always best to speak to an attorney to find out more specific information about your case.

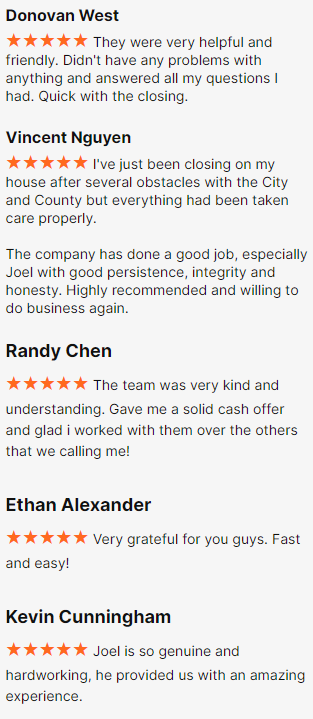

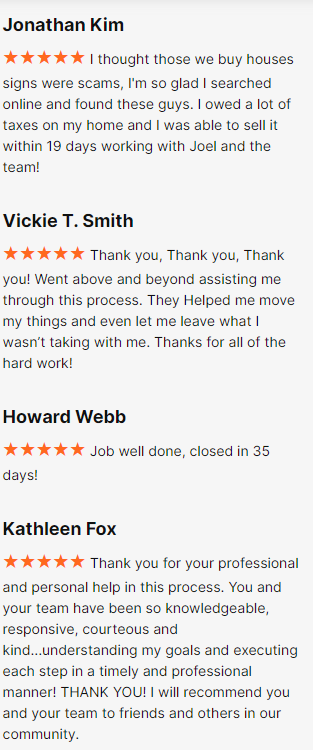

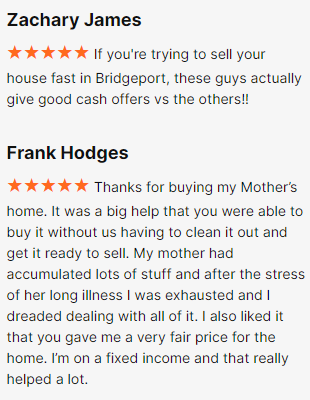

Happy Customers