Fire Insurance Claim Calculation

The fire insurance claim calculation is a systematic process of estimating the extent of damage caused by a fire in a property. The claim amount is based on the cost of repairs, depreciation value, and other factors like loss of rent.

The claim process involves three key players – the property owner or policyholder, the insurance company, and an independent third-party known as an appraiser who evaluates the extent of the damage.

Fire Insurance Claim Calculation Tax and What is It?

Fire insurance claims can be paid in two ways; either by the insurer directly or by the insured person. If the claim is paid directly by the insurance provider, there is no need to calculate. But if the insured person pays it, there is a need to calculate the tax payable. It is called fire insurance claim calculation tax or 'claims tax.'

The tax payable on fire insurance claims calculated as follows:

Value of property damaged x 3% = amount of tax payable

How Do I Claim Fire Loss On Income Tax?

You can claim the loss on your income tax return if you have filed one. You will have to give information about the destroyed building in your tax return, including the address and other details. If you have not filed an income tax return, you can claim the compensation after filing a return.

If you are claiming a loss of business income, you must have kept all the necessary records to support your claim. You should not include other expenses such as property taxes or insurance premiums in your calculation while filing your income tax returns.

How To Calculate Fire Insurance Claim

The formula used to calculate fire insurance claims is:

Homeowners Insurance claim amount = Actual cash value – depreciation – loss adjustment expenses – non-weather related expenses

How Do I Get The Most Out Of My Fire Insurance Claim?

If your home was damaged in a fire, you might be able to claim with your homeowners insurance company. If the property is a total loss, they will pay you an amount equal to the house's value before it was damaged by fire, minus your deductible. If only part of the property were damaged by fire, they would pay for repairs up to that amount less your deductible. However, suppose you have renters insurance (which many homeowners do). In that case, you shouldn't bother with filing a claim with your homeowners insurance adjuster because you'll likely get more money back by filing a claim with your renter's insurance company instead.

How Do You Calculate Fire Loss?

The loss adjusters calculate fire losses who have experience dealing with this type of loss. They will assess the damage, and then they will use the following formula:

Loss = Cost of replacing damaged items + Cost of repairing damaged items + Cost of restoring damaged items - Depreciation - Insurance premium paid

This formula is used to determine if there is a profit or loss for a claim. Depreciation is subtracted as it represents the value of lost time instead of physical damage.

How Are Claims Calculated In Case Of Fire Insurance

The total amount of the claim is calculated based on the property's value. If you have insured your home with a sum insured of Rs 1 crore and it is gutted, you will get Rs 1 crore as compensation from the insurance company. If there are any additional damages caused by fire like smoke damage, you can claim for that too. The sum insured should be equal to or more than the market value of your house at the time of purchase.

If you have taken a home loan, your lender may ask for a valuation certificate (VCC) from an independent surveyor before disbursing fresh loans. Suppose there are any structural changes made to your property after taking a loan. In that case, you need to get an updated VCC from an independent surveyor to avoid any issues later on.

How To File Fire Insurance Claims For Damage

It is always advisable to contact your insurance agent as soon as possible after the loss. Your insurance company may require that you file a police report or contact your landlord, condominium association, or building manager.

What Is The Process For Filing Fire Insurance Claims?

The process for filing a fire insurance claim depends on the type of policy you have. Most policies require you to submit an official claim form and supporting documentation, such as receipts or invoices, to the insurance provider within 30 days of the event. The insurer then investigates the claim to determine whether it's valid and verifies that all required documentation has been submitted. Once they're satisfied, they'll either pay out on your claim or decline it.

Fire Insurance Claim Formula

The formula for calculating the property insurance claim of fire is as follows:

Cost of damage to the property + Cost of repairs to the property + Loss of rent during repairs + Other costs (indemnity)

The cost of damage to the property includes loss or damage to contents and structure. The cost of repairs includes the cost of labor and material. The loss of rent during repairs includes rental value less expected rental income. Other costs include other expenses resulting from fire damage like medical bills, legal fees, etc.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

What Is the Average Policy In Fire Insurance?

The average policy in fire insurance is the average value of the goods insured. It's calculated by adding all covered items on your policy and dividing this sum by the number of items. The result is an average value used to determine how much money you will get if you claim fire damage.

Average in-house fire insurance does not necessarily reflect what you paid for the items or their current value. Instead, it's meant to give you a rough idea of how much money you'll be able to get back if something happens to your possessions and they're lost or damaged in a fire.

How Is Net Claim Calculated?

The net claim is the amount of money that an insurance company will pay you due to your claim. It can also be referred to as "the net settlement amount."

The calculation of net claims involves subtracting the amount of any applicable deductibles and other out-of-pocket expenses from the total amount claimed by the insured party.

The formula for determining the net settlement amount is:

Net Settlement Amount = Actual Value of cash - Deductible - Other Out-of-Pocket Expenses

For example, if you have a policy with a $500 deductible and make a claim for $1,000 worth of property damage, your net settlement amount would be $500 (actual cash value minus deductible).

What Is the Average Clause In Fire Insurance Claim?

The average Clause is an important provision in a fire insurance policy that specifies the amount of loss the insurer will be liable for. It is also known as "loss assessment" or "physical damage assessment clause." The average clause has been introduced to protect insurers from paying excessive claims due to fraud and overstating losses by insured persons.

How Is Average Clause Formula Calculated?

This clause is used when the insured property has suffered partial damage. The average clause formula is used to calculate the number of insurance claims. The average clause works on the principle that the total loss of property calculated by the insurer is divided by the total number of items affected. This way, you will get an average value per unit that can be paid as compensation for each item damaged during a fire.

Average Clause Formula = Total Value of house Fire Claim / Number of Years Policy Is In Force

For example, if there are 100 claims made in a year and you have had your policy for two years, then:

Average Clause Formula = Total Value of Fire Claims / Number of Years Policy Is In Force

100 / 2 = 50

Therefore, the average claim for this type of coverage will be $50 per claim.

Fire Insurance Claim Calculation Made Easy

Fire insurance claim calculation has three main components: building cost and recoverable depreciation, furniture, fixtures and fittings, stock, and general contents. To discover the best approach to selling a fire damaged house, accurately calculate your homeowner's insurance claim for fire, you will need to examine the renovation works carried out on the property before the fire damage.

Many home insurance companies provide fire insurance. However, finding a reputable one among them can be difficult; however, this task is not impossible with little research and the best of help from the internet. When dealing with a fire damaged house, it becomes crucial to explore various selling strategies to maximize your return on investment and attract potential buyers.

Addition Information You Should Know

- How Does Insurance Work After A House Fire

- How To Deal With A Difficult Insurance Adjuster After a House Fire

- All You Need to Know About Your House Fire Insurance Payout

- Can You Keep The Extra Money From The Insurance Claim

- What Can You Do If Your Fire Insurance Claim Gets Denied

- House Fire But I Have No Insurance

- How Much Is Fire Insurance

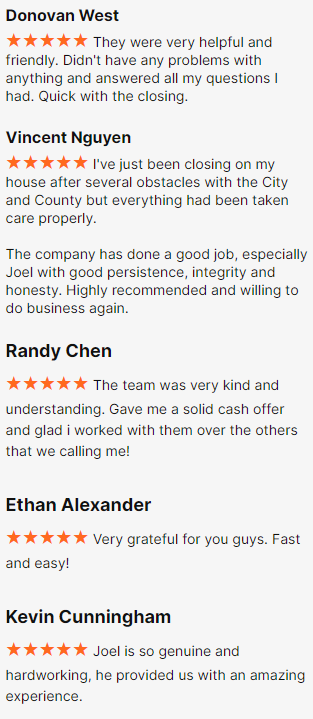

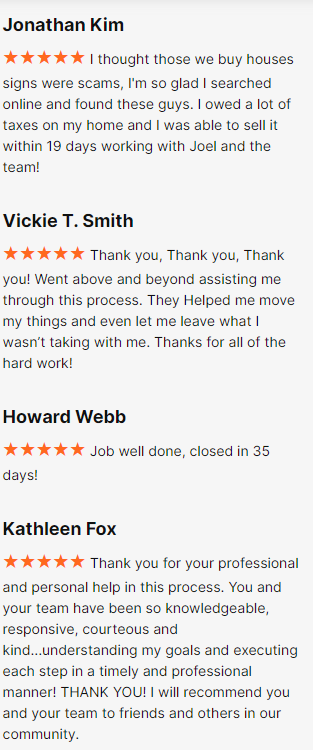

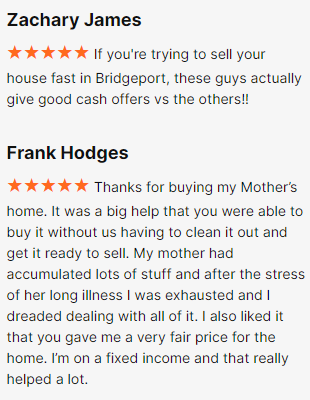

Happy Customers