How to Sell a Burned House - Get the Most Value for Your Fire-Damaged Property

We Buy Burned Houses

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

Selling a burned house might seem like an insurmountable challenge, but with the right strategy and guidance, it’s possible to get the most value for your fire-damaged property. In this blog post, we’ll explore various selling options, assess the extent of fire damage, and navigate the complex world of insurance claims, repairs, and negotiations. By the end, you’ll have a clear understanding of how to sell a burned house and turn a seemingly hopeless situation into a successful sale.

Key Takeaways For Selling A Fire Damaged House

- Examine the pros and cons of three options for selling a fire-damaged house - cash buyers, realtors, and auctions.

- Understand insurance claims & coverage to determine the financial feasibility of repairs/renovations.

- Handle negotiations with patience & negotiation skills to achieve fair selling price through counteroffers.

Selling Options for Fire-Damaged Houses

When it comes to selling a fire-damaged house, there are several options to consider. Each has its own set of advantages and disadvantages, depending on the extent of the fire damage and your individual needs. One option is to sell fire-damaged houses to companies that buy fire-damaged houses, as they specialize in dealing with such properties.

In this section, we’ll examine three main options: selling as-is to cash buyers, listing with a realtor, and auction sales. By understanding the pros and cons of each approach, you’ll be better equipped to make an informed decision and maximize the value of your fire-damaged property.

Selling As-Is to Cash Buyers

Selling a fire-damaged house as-is to cash buyers can be a quick and hassle-free option, but it may result in a lower selling price. Cash buyers are typically real estate investors who are willing to purchase fire-damaged properties without requiring repairs or renovations. They often have the funds readily available and can close the deal in a short timeframe, making this an appealing option for sellers who want to move on quickly.

However, cash buyers may offer less than the property’s fair market value, as they factor in the costs of necessary repairs and potential risks associated with the fire damage. To ensure a fair deal, it’s important to research the market value of your property and be prepared to negotiate with potential cash buyers.

Being transparent about the extent of the fire damage and any insurance claims can also help establish trust and facilitate a smoother transaction.

Listing with a Realtor

Listing a fire-damaged house with a realtor can help with marketing and negotiation, but may require repairs and take longer to sell. Realtors have experience and resources to effectively market your property, reaching a wider audience of potential buyers. They can also help you navigate the negotiation process and ensure that you receive a fair selling price for your fire-damaged home.

However, listing with a realtor may require you to invest in repairs and renovations to make the property more appealing to buyers. This can be time-consuming and costly, especially if the fire damage is extensive. Additionally, selling through a realtor may take longer than selling as-is to cash buyers, as the property will need to be shown to potential buyers and there may be a longer negotiation period.

Auction Sales

Auction sales can be a fast and reliable method for selling a fire-damaged house, with investors competing to drive up the price. Auctions create a sense of urgency and competition among potential buyers, often resulting in higher selling prices than traditional sales methods. They also provide a precise timeframe for the sale, allowing you to plan accordingly and minimize long-term carrying costs.

However, selling a fire-damaged house at an auction may not always result in the desired price, as potential buyers may be more cautious about bidding on a property with fire damage. To increase the chances of a successful auction sale, it’s important to:

- Be transparent about the extent of the fire damage and any repairs that have been completed.

- Provide detailed information about the property and its condition.

- Build trust with potential buyers.

- Encourage more competitive bidding.

Assessing the Extent of Fire Damage

Assessing the extent of fire damage is crucial for determining the best selling strategy and understanding insurance claims and coverage. A thorough assessment will help you decide which selling option is most suitable for your situation and provide valuable information for potential buyers.

In this section, we’ll explore the differences between minor and major fire damage, as well as the importance of insurance claims and coverage in the selling process.

Minor vs. Major Fire Damage

The difference between minor and major fire damage can significantly impact the selling process and potential buyer interest. Minor fire damage may include limited structural damage, smoke damage, or damage to personal belongings. In these cases, the required repairs may be less extensive, and the home may still be attractive to a wider range of potential buyers.

Major fire damage, on the other hand, may involve significant structural damage, extensive smoke and soot damage, or damage to electrical systems. These types of damage can drastically reduce the property’s value and make it more difficult to sell fire damaged homes. In such cases, it may be necessary to invest in costly repairs or renovations, or consider alternative selling options such as selling as-is to cash buyers or at an auction, especially after a house fire.

Insurance Claims and Coverage

Understanding insurance claims and coverage is essential for determining the financial feasibility of repairs and renovations. Insurance policies typically cover the cost of repairs or replacement of damaged property, up to the policy limits. It’s important to review your insurance policy and discuss the extent of coverage with your insurance company to determine what costs will be covered.

In addition to understanding your insurance coverage, it’s crucial to keep detailed records of all repairs and renovations completed on the property. This information will not only be important for potential buyers, but may also be required for insurance claims and reimbursement. By staying organized and informed, you’ll be better prepared to navigate the complex world of insurance claims and coverage when selling your fire-damaged house.

Preparing Your Burned House for Sale

Preparing a burned house for sale involves cleanup, debris removal, and necessary repairs or renovations to make the property more appealing to potential buyers. This process can be both time-consuming and costly, but it’s essential for maximizing the value of your fire-damaged property and ensuring a successful sale.

In this section, we’ll discuss the importance of proper cleanup, debris removal, and necessary repairs or renovations in preparing your burned house for sale.

Cleanup and Debris Removal

Proper cleanup and debris removal are essential for presenting a fire-damaged house in the best possible light. This process involves removing any damaged materials from the property, including furniture, carpets, and drywall. It’s important to take precautions when handling debris, as it may be contaminated with toxic substances from the fire. Consulting with the fire department can provide valuable guidance in this regard.

In addition to debris removal, thorough cleaning of the property is necessary to eliminate any lingering smoke odors and soot residue. This may involve using specialized cleaning products and equipment, as well as hiring professional fire damage restoration services. By ensuring that your property is clean and free of debris, you’ll create a more appealing and inviting environment for potential buyers.

Necessary Repairs and Renovations

Necessary repairs and renovations can increase the property’s value and attract more potential buyers. Depending on the extent of the fire damage, this may involve addressing structural damage, inspecting and repairing electrical systems, or cleaning and restoring individual rooms. It’s important to work with qualified professionals who specialize in repair fire damage to ensure that the work is done properly and meets all safety standards.

In addition to necessary repairs, consider making cosmetic improvements to the property to further enhance its appeal. This may include painting, landscaping, or updating fixtures and finishes. Investing in these improvements can not only increase the value of your fire-damaged house, but also help overcome any stigma associated with fire-damaged properties, making it more attractive to potential buyers.

Disclosing Fire Damage to Potential Buyers

Disclosing fire damage to potential buyers is a legal requirement and helps build trust with buyers, ensuring a smoother selling process. In this section, we’ll discuss:

- The importance of disclosing fire damage

- The legal requirements for doing so

- The benefits of building trust with potential buyers through honesty and transparency.

Disclosing fire damage is important because it helps buyers make an informed decision about the property.

Legal Requirements

Legal requirements for disclosing fire damage vary by state, but honesty and transparency are crucial for avoiding potential legal issues. In many states, it’s legally required or considered best practice to disclose any known fire damage when selling a property. Failure to disclose this information can lead to legal disputes and may result in financial penalties or the nullification of the sale.

When disclosing fire damage to potential buyers, it’s important to provide detailed information about the damage and any repairs that have been completed. This may include insurance claims, repair receipts, and any documentation related to the cause of the fire. By being open and transparent about the fire damage, you’ll not only meet your legal obligations, but also help to build trust with potential buyers, increasing the likelihood of a successful sale.

Building Trust with Buyers

Building trust with buyers by being honest about the fire incident and its cause can help overcome any stigma associated with fire-damaged properties. When discussing the fire damage with potential buyers, it’s important to:

- Be forthright and provide accurate information about the extent of the damage

- Explain the cause of the fire

- Share any steps taken to prevent a recurrence

In addition to being honest about the fire damage, providing comprehensive information about the repairs and renovations completed on the property can also help build trust with buyers. This includes sharing documentation of the work completed, as well as any warranties or guarantees provided by contractors. By demonstrating that the property has been properly repaired and restored, you’ll reassure potential buyers that the house is a safe and valuable investment.

Estimating the Value of Your Fire-Damaged House

Estimating the value of a fire-damaged house involves appraisals, local realtor estimates, and market comparisons to determine a fair selling price. In this section, we’ll explore the importance of these different valuation methods and how they can help you accurately estimate the value of your fire-damaged property. Ensuring that you receive a fair price for your home is essential.

The appraisals and local realtor estimates are important for determining the current market.

Appraisals and Local Realtor Estimates

Appraisals from mortgage lenders or estimates from local realtors can help determine the value of a fire-damaged house. These professionals will assess the property’s condition, taking into account factors such as the extent of the damage, the location of the property, and the current market conditions.

It’s important to obtain multiple appraisals or estimates to ensure that you have a comprehensive understanding of the property’s value. Comparing these valuations can provide insight into the potential selling price and help you make informed decisions about repairs, renovations, and selling strategies.

By working with professionals who specialize in fire-damaged properties and following the guidelines set by the National Fire Protection Association, you’ll be better equipped to navigate the complex world of property valuation and achieve a fair selling price for your home.

Market Comparisons

Market comparisons can provide insight into how similar fire-damaged properties have sold in the area, helping to establish a realistic selling price. By researching recent sales of comparable properties, you’ll gain a better understanding of the local market and the potential value of your fire-damaged house.

When using market comparisons, it’s important to consider factors such as the size of the property, the condition of the property, and the current market conditions. Adjustments may need to be made to account for differences in the extent of the fire damage or any repairs and renovations completed on the property. By taking these factors into account, you’ll be better positioned to estimate the value of your fire-damaged house and set a realistic selling price that is fair to both you and potential buyers.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

Navigating Negotiations and Offers

Navigating negotiations and offers for a fire-damaged house involves handling lowball offers, and counteroffers, and closing the deal in a way that benefits both the seller and the buyer. In this section, we’ll discuss strategies for managing undervalued offers, formulating counteroffers, and ensuring the successful completion of the deal.

When dealing with lowball offers, it’s important to remember that the buyer is likely to be the buyer.

Handling Lowball Offers

Handling lowball offers requires patience and negotiation skills to ensure a fair selling price is achieved. When faced with a lowball offer, it’s important not to react impulsively or take the offer personally. Instead, try to understand the reasoning behind the offer and assess whether there’s room for negotiation.

If you believe the offer is unreasonably low, consider presenting a counteroffer that reflects the true value of your fire-damaged house. Be prepared to provide justification for your counteroffer, such as documentation of repairs and renovations completed, or market comparisons with similar properties.

With patience and effective negotiation, you can work towards a selling price that is fair and acceptable to both you and the potential buyer.

Counteroffers and Closing the Deal

Counteroffers and closing the deal involve finding a balance between the seller’s desired price and the buyer’s willingness to pay, ultimately resulting in a successful sale. When formulating a counteroffer, it’s important to consider the fair market value of the property, the extent of the fire damage, and any associated risks or costs.

During negotiations, maintaining open and honest communication with the buyer is crucial for building trust and reaching an agreement that satisfies both parties. Once a suitable price has been agreed upon, it’s important to ensure that all necessary documentation is in order and all legal requirements are met, paving the way for a smooth and successful sale of your fire-damaged house.

Summary

In conclusion, selling a fire-damaged house may seem like a daunting task, but with a strategic approach and the right resources, it’s possible to achieve a successful sale. By exploring various selling options, assessing the extent of fire damage, preparing the property for sale, and navigating negotiations and offers, you can maximize the value of your fire-damaged property and move forward with confidence. Remember, the key to success lies in transparency, patience, and persistence – with these qualities, you’ll be well on your way to turning a seemingly hopeless situation into a rewarding outcome.

Frequently Asked Questions

Does a house lose value after a fire?

Yes, a house can lose value after a fire, but that doesn’t have to be the case. The extent of damage and type of repairs used in restoring the property will determine the long-term value of the home. So, with the right approach and resources, it’s possible to minimize the depreciation of value.

Is it a good idea to buy a house that had a fire?

Overall, it is a smart financial decision to buy a fire-damaged house if the repair costs are not too great. As long as you do your research and make sure that any necessary repairs have been made before purchasing, you can save money in the long run.

Does house fire need to be disclosed?

When selling a home, it is important for sellers to be honest and disclose any knowledge they have about the condition of the house, including any damage from a past fire. This helps the buyer make an informed decision and ensures that everyone can negotiate in good faith.

As such, any house fire should be disclosed.

What are the main selling options for fire-damaged houses?

For fire-damaged houses, the most common selling options are cash buyers, listing with a realtor, or auction sales. These methods provide sellers with an opportunity to dispose of their property in the quickest and most profitable manner possible.

How can I determine the extent of fire damage to my house?

To determine the extent of fire damage to your house, it is important to consult with qualified professionals who specialize in assessing damage caused by fire. Working with an adjuster and/or restoration expert can help you get a better understanding of the full scope of repairs that need to be done.

By understanding the full scope of repairs, you can make an informed decision about how to proceed with the repairs and restoration of your home. This will help you to ensure that the repairs are done correctly and that your home is restored.

We Buy Burned Houses

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

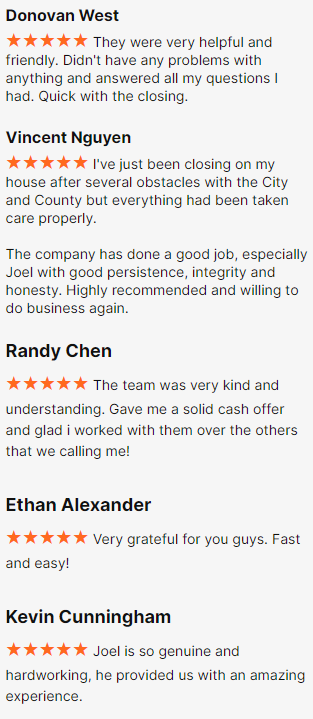

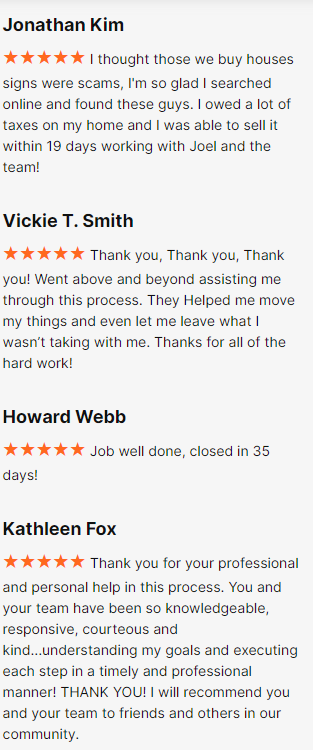

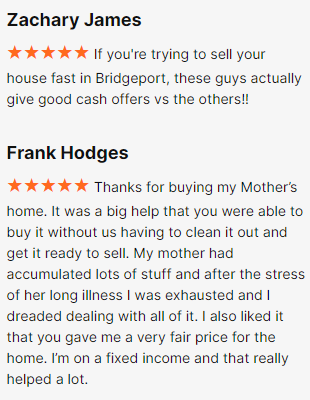

Happy Customers

All Rights Reserved | Fire Cash Buyers