Sell House Tree Damage

We Buy Tree Damaged Houses

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

As a homeowner looking to go through with a home sale, you will need to assess your property for any damage caused by natural forces, including dangerous trees, before listing; why? If your home is unfortunate enough to have had a fallen tree hit and cause extensive damage, it can be devastating and expensive for you as a homeowner and potential new owners.

Luckily, there are steps that you can take to sell your home with tree damage and avoid these issues altogether. Here's what you need to know:

Does Homeowners Insurance Cover Tree Damage?

How much coverage you have is dependent on the type of policy you have and what state you reside in as a property owner. Some policies provide more coverage than others, but all policies will include some form of tree damage coverage.

How much your policy covers depends on what type of insurance it is: homeowners or renters insurance, business property insurance, and so forth. The amount that an insurer will pay for tree damage depends largely on how severely damaged your home is, including structural damage, issues from fallen power lines, fire, and if there was any damage to a neighbor's yard.

If your neighbor's tree falls on your home and causes damage, then their homeowner's insurance will cover the damages based on where the tree fell and where the property line lies surrounding the tree, but it's best to always call your insurance company; why?

Call Your Homeowners' Insurance Company

While you might be typically responsible for falling trees in your yard or on your home, you might not always be. Reaching out to your homeowner's insurance to see what tree removal services and other tree services could be covered under your policy is suggested before trying to sell your home after tree damage. Here's why:

- Ask if you are covered for tree damage and what options are available if you are not.

- If you have coverage, learn about the process for filing a claim with them.

Finding out the answer to these issues will help you and your real estate agent in selling your otherwise damaged home. If your insurance company covered some or all of the repair costs, then this will help you recoup your losses and ensure a larger closing price on your upcoming sale, whereas if your insurance company does not cover any of the costs of fallen tree removal or damage made to your home, you will lose some curb appeal and eventually secure a lower contract price for your home - which no one wants.

What if You Don't Have Homeowners' Insurance?

If you don't have homeowners insurance and the tree didn't come from your neighbor's property, then your best bet is to either pay for the tree's removal out of pocket and the repairs needed to sell your home or try to sell your home as is.

Disclosing Sick or Dead Tree Areas on Your Property When Selling Your Home

Depending on where you live, you might need to disclose any sick or dying trees on your property. You can do this by holding a quick tree inspection around your property and looking for signs of decay on larger trees.

Inspect Remaining Trees Before Selling Your Home for Sick Trees

Before you put your house on the market, it's important to inspect the remaining trees in your yard. Look for dead branches and dying trees that may pose a danger to buyers.

Also, look at areas of tree damage and disease or fungus growth on the trunk of a tree near your home.

If there are any trees touching power lines, these should be removed before listing as well so that potential buyers do not assume that those lines were installed recently.

Will Buyers Purchase a Home that Needs Tree Removal?

Buyers are more likely to purchase a home with tree damage if it's a small problem. If you have some minor damage, like broken branches, overhanging branches, tree debris, or a large root system in your yard, it may not be enough for buyers to turn their backs on your property.

However, if there is significant damage from the storm and it affects the overall appearance of your house, then buyers may not be interested in purchasing this home. This could be due to an aesthetic reason or because they are concerned about potential structural issues arising down the line to the property. This could come up during a home inspection when your potential buyer conducts a full check-up of the home for safety hazard issues.

Buyers may also be willing to purchase a home that needs tree removal if they can negotiate a lower price based on its current condition.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

Who Will Purchase Your Home with Tree Damage?

If you are looking for a buyer who will purchase your home with tree damage, there are several options. The first group of buyers is those who are looking for a fixer-upper. This group would be willing to pay less and/or do some work themselves to make the property livable again.

They may also be willing to take on some risk in order to save money--for example, if they know that the house would need extensive repairs, they might consider purchasing it even though there is tree damage present in order not only to save money but also get something out of it before eventually selling or renting out the property after making repairs.

The second group would be investors or flippers who, during contract negotiations, might offer a little bit higher price than the buyers mentioned above. They also would make the needed repairs to the property damage, oftentimes will not require a home inspection or hire a home inspector, and in most cases will pay cash for your home.

Tree damage can affect your ability to sell your house. If there is damage to the structure or exterior of the home, then it will be difficult for buyers to purchase it.

However, if you have homeowners' insurance coverage or an accurate estimate of repair costs, then it may be possible for someone else to buy the property once repairs are made, or you could go the easier and quicker route of selling your home as is with written communication to the buyer regarding the material fact of the home, potential repairs estimates, and information on a local certified arborist who can help clean up the damaged tree, including removal costs.

We Buy Houses As-Is For Cash

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

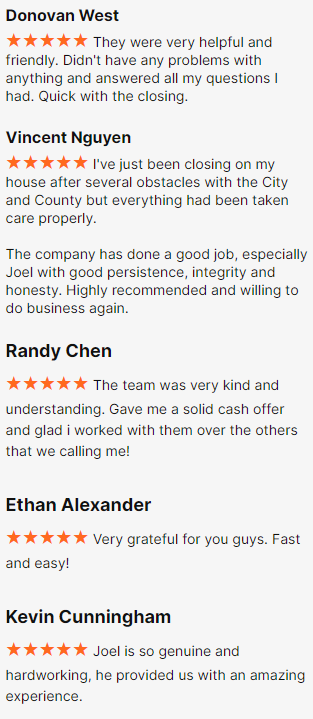

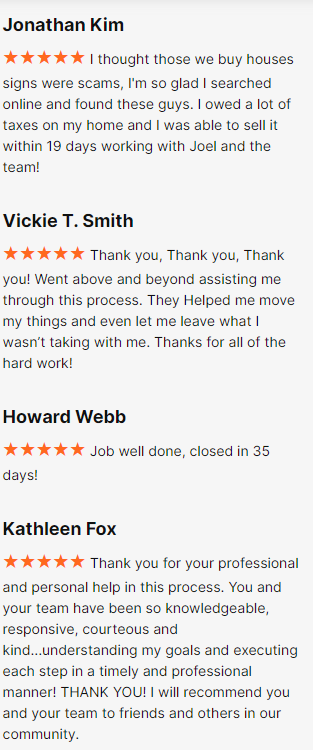

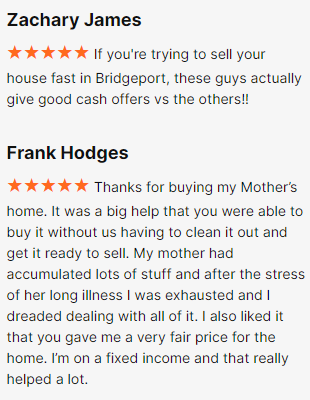

Happy Customers

All Rights Reserved | Fire Cash Buyers