How to Sell an Inherited House Fast in 2023

We Buy Inherited Houses

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

Inheriting a house can be a bittersweet experience, as it often comes with emotional baggage and unexpected challenges. Selling an inherited house can be even more daunting, as there are various legal, financial, and emotional aspects to consider. But fear not! In this comprehensive guide, you’ll discover effective strategies and tips to navigate this complex process and sell an inherited house fast, ensuring a swift and smooth transaction.

Key Takeaways For Selling an Inherited House

- Determine the fair market value of an inherited property and research local real estate investors for a fast sale.

- Utilize tax exemptions and reduction strategies to minimize potential liabilities when selling.

- Collaborate with co-owners through open communication, compromise, and dispute resolution methods to expedite the process.

Quick Tips for Selling an Inherited House Fast

Selling an inherited property comes with unique challenges, such as determining the fair market value, collaborating with co-owners, and navigating the probate process. However, by employing some smart strategies, you can expedite the sale and make the most of this opportunity. The key lies in understanding the value of your property and leveraging the expertise of local real estate investors who can offer cash deals and help you sell inherited property with ease.

Two crucial steps for a fast sale are determining the fair market value of the property and looking for local real estate investors in your area. These approaches can not only ensure you get the best deal for your inherited house, but also help you avoid potential legal and financial pitfalls.

Determine the Fair Market Value

Determining the fair market value of your inherited property is an essential step in setting a competitive price that attracts potential buyers. To do this, consider obtaining appraisals from two or three local real estate agents who can provide a written estimate of the property’s value after touring it.

This information will help you set a realistic price, which is crucial in attracting prospective buyers such as local real estate investors, cash buyers, and iBuyers, ultimately facilitating a faster sale.

Look For Local Real Estate Investors In Your Area Like Us

Local real estate investors can be a valuable resource when selling an inherited property, as they typically offer cash deals that can expedite the selling process. These investors can be found through local real estate investment clubs, online directories, or even through referrals from friends or family members.

When evaluating potential investors, consider their experience, reputation, and financial stability, and seek testimonials from previous clients. Be prepared to negotiate and communicate your expectations clearly to ensure a smooth transaction and a fast sale.

The Probate Process and Its Impact on Selling Speed

The probate process is a legal procedure that can significantly impact the speed of selling an inherited property. This process involves the distribution of the deceased’s assets, including real estate, to creditors and heirs according to the will or state law. The executor or personal representative is responsible for managing the estate’s assets and ensuring the property is transferred to the designated beneficiaries.

Understanding and navigating the probate process is essential for selling an inherited property, as it can influence the time it takes to complete the sale. By familiarizing yourself with the probate process and collaborating with a knowledgeable probate attorney, you can help ensure a smoother and faster sale.

Navigating Probate

Navigating the probate process involves understanding the legal procedures, appointing an executor, and managing the estate’s assets. The executor or personal representative is responsible for processing all relevant paperwork, settling the estate’s debts, filing any required tax returns on behalf of the estate, and transferring the property and assets to the designated beneficiaries. In some cases, a simplified probate option called a small estate probate may be available, allowing for a faster transfer of assets with minimal court involvement.

When selling an inherited property, it’s essential to work closely with a real estate attorney who can help ensure that the ownership is legally and properly transferred. By understanding the probate process and working with experienced professionals, you can avoid potential delays and complications, ultimately expediting the sale of your inherited property.

Selling During Probate

Selling a property during the probate process may be possible if the executor or personal representative has the authority to sell the property and all estate debts have been paid. In such cases, the property may be sold before it’s transferred to the designated beneficiaries.

However, it’s essential to consult with a probate attorney who can help you understand the legal requirements and implications of selling during probate to ensure a smooth and speedy sale.

Choosing the Right Real Estate Agent to Expedite the Sale

Choosing the right real estate agent is crucial when selling an inherited property, as their expertise and guidance can significantly impact the speed of the sale. A skilled agent can help you navigate the complexities of selling an inherited property, such as determining the fair market value, collaborating with co-owners, and addressing any legal or financial challenges.

An agent with expertise in inherited properties and strong negotiation skills is especially valuable, as they can help secure the best deal for your property and ensure a faster sale. In the following sections, we’ll delve deeper into the importance of these qualities in your chosen real estate agent.

Expertise in Inherited Properties

Working with a real estate agent who has expertise in inherited properties can provide invaluable guidance throughout the selling process. These agents are well-versed in addressing the unique challenges that come with selling inherited properties, such as handling the probate process, managing co-owner relationships, and understanding any potential tax implications.

By collaborating with an experienced agent, you can navigate the complexities of selling an inherited property more efficiently and expedite the sale.

Negotiation Skills

The negotiation skills of your chosen real estate agent can play a vital role in expediting the sale of your inherited property. A skilled negotiator can help you secure the best possible deal for your property, ensuring that you receive a fair price and that the sale proceeds smoothly.

By selecting an agent with strong negotiation skills, you can increase your chances of selling your inherited property quickly and for the best possible price.

Alternative Options for a Fast Sale

In addition to working with a real estate agent, there are alternative options for selling an inherited property quickly. These options include cash buyers and iBuyers, both of which can offer fast deals and streamline the selling process.

Cash buyers are typically local real estate investors who can pay cash for your property, eliminating the need for financing and speeding up the sale process. This means you won’t have to worry about mortgage payments during the transaction. iBuyers, on the other hand, use technology to make instant offers on properties, allowing for a faster sale without the need for traditional marketing or open houses.

Each of these options has its own set of advantages and drawbacks, which we’ll explore in more detail below.

Cash Buyers

Cash buyers can offer a quick solution for selling an inherited property, as they can provide cash deals and eliminate the need for financing. This can significantly speed up the sale process, allowing you to close the deal in as little as two weeks.

However, it’s essential to conduct thorough research and ensure the cash buyer is reliable before proceeding with the sale. Be prepared to negotiate and communicate your expectations clearly to secure the best possible deal for your property.

iBuyers

iBuyers are another alternative option for a fast sale, as they use technology to make instant offers on properties. This allows you to sell your inherited property quickly and efficiently, without the need for traditional marketing or open houses.

However, it’s important to consider the potential drawbacks of this option, such as receiving a lower price than the property’s true market value. Weigh the pros and cons carefully before choosing to work with an iBuyer to ensure you make the best decision for your situation.

Handling Inherited Property Taxes and Capital Gains

Handling inherited property taxes, inheritance tax, and capital gains can have a significant impact on the speed of the sale and your overall financial outcome. When selling an inherited property, you may be liable for capital gains taxes on any profits made from the sale, depending on the property’s value at the time of inheritance and the subsequent sale price. By understanding the tax implications and employing tax exemptions and reduction strategies, you can minimize your tax liabilities and expedite the sale process.

In the following sections, we’ll explore capital gains tax on inherited properties and discuss various tax exemptions and reduction strategies to help you minimize your tax liabilities and sell your inherited property quickly.

Understanding Capital Gains Tax on Inherited Property

Capital gains tax is levied on the profit derived from the sale of an inherited property when the sale price exceeds the property’s value at the time of inheritance. Understanding capital gains tax on inherited property can help you plan for potential tax liabilities and make informed decisions about the sale process, including when to pay capital gains taxes.

By considering factors such as the “stepped up” value of the property and your eligibility for the home sale tax exclusion, you can minimize your tax liabilities, pay taxes more efficiently, and sell your inherited property more efficiently.

Tax Exemptions and Reduction Strategies

There are several tax exemptions and reduction strategies, including federal estate tax considerations, that can help minimize taxes on the sale of an inherited property. One such strategy is the home sale tax exclusion, which allows you to exclude a significant portion of the gain from the sale of your primary residence from capital gains tax. By making the inherited property your primary residence for a period of two years, you may be eligible to exclude $250,000 of the gain ($500,000 for married couples filing jointly) from capital gains tax.

Understanding and employing these strategies can help you navigate the tax implications of selling your inherited property and expedite the sale process.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

Collaborating with Co-Owners for a Fast Sale

When you inherit a property with other family members or co-owners, effective collaboration becomes crucial for ensuring a fast and smooth sale. Open communication and planning among co-owners can help streamline the selling process and prevent potential conflicts or delays. By working together, co-owners can make informed decisions about the sale of the inherited property and navigate any challenges that may arise.

In the following sections, we’ll discuss the importance of communication and planning among co-owners, as well as strategies for resolving disputes that may arise during the selling process.

Communication and Planning

Open communication and planning among co-owners are essential for facilitating a smooth and expedited sale of an inherited property. By discussing expectations, goals, and potential challenges, co-owners can ensure that all parties are on the same page and work together effectively.

In addition to maintaining open dialogue, consulting with a real estate agent and a real estate attorney can help co-owners navigate the complexities of selling an inherited property and ensure a seamless sale process.

Resolving Disputes

Disputes among co-owners can hinder the selling process and create tension among family members. To resolve disputes effectively, it’s important to maintain open communication and strive for compromise. If an agreement cannot be reached, co-owners may need to seek legal recourse through a court or alternative dispute resolution methods, such as mediation or arbitration.

By addressing disputes proactively and working towards a resolution, co-owners can expedite the sale of the inherited property and ensure a successful outcome for all parties involved.

Summary

Selling an inherited property can be a complex and emotional experience, but with the right strategies and guidance, you can navigate this process with confidence and expedite the sale. By determining the fair market value, working with local real estate investors, understanding the probate process, and collaborating effectively with co-owners, you can overcome the challenges of selling an inherited property and make the most of this opportunity.

Remember, thorough planning, effective communication, and the support of experienced professionals are crucial for ensuring a smooth and successful sale. With the knowledge and tools provided in this guide, you can confidently sell your inherited property and move forward with your life.

Frequently Asked Questions

What happens if one person wants to sell an inherited house and the other doesn't?

If one person wishes to sell an inherited house but the other does not, a partition lawsuit may be necessary in order to settle the dispute. In this case, the judge will evaluate both sides and potentially terminate the co-ownership, ordering the property to be sold and dividing up the proceeds accordingly.

Is it better to keep or sell an inherited house?

In the case of an inherited house, it is important to weigh the pros and cons of keeping or selling. If time is not an issue and the home can be rented out for a good return on investment, it might be best to keep the house; otherwise, selling to an investor may be the best option.

Selling to an investor can be a great way to quickly liquidate the asset and free up capital for other investments. It is important to research the market and find a reputable investor who can offer a reputable investment.

How do I avoid capital gains tax when selling an inherited property?

By following the right steps, you can avoid paying capital gains tax on your inherited property. Quickly selling the property, making it your primary residence, renting it out, disclaiming it, and deducting any expenses associated with the sale are all smart ways to keep your hard-earned money in your pocket.

These steps can help you save money and ensure that you don’t have to pay any unnecessary taxes. It’s important to understand the tax implications of any decisions you make when it comes to taxation.

Is there capital gains tax on selling an inherited house?

In summary, there is capital gains tax on selling an inherited house. The IRS applies a stepped-up cost basis, meaning any taxes due will only be on gains made since the asset was inherited.

Depending on your income bracket, the tax rate would be 0%, 15%, or 20%.

How do I determine the fair market value of my inherited property?

In order to determine the fair market value of your inherited property, it is recommended to seek out independent appraisals from local real estate agents to get an accurate estimate.

This is the best way to ensure that you are getting an accurate assessment of the value of the property. It is important to remember that the appraised value of the property may be different from the actual market value, so it is important to do your research.

We Buy Inherited Houses

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

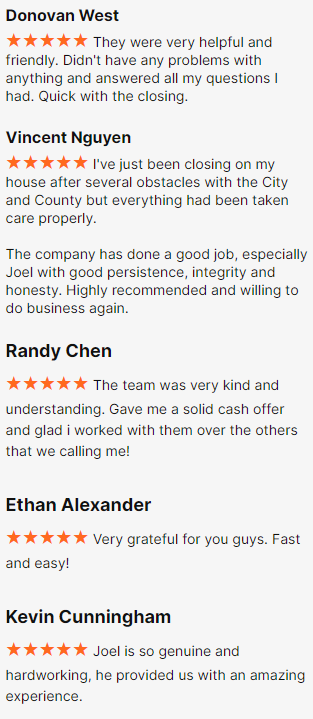

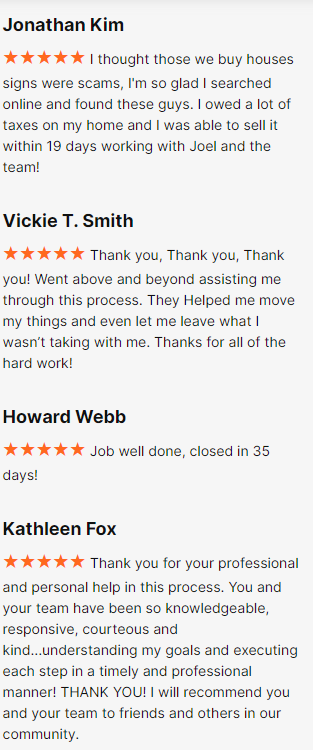

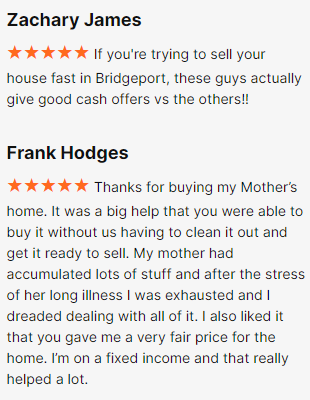

Happy Customers

All Rights Reserved | Fire Cash Buyers