Why Do I Have to Do a Contents List After a Fire

We Buy Fire Damaged Houses

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

Life after a house fire can be challenging without having to deal with your homeowners insurance company. Adjusting to finding temporary housing, the fire department, insurance claims, and everything else that comes along with a disaster is time-consuming.

Filling out a contents list after a house fire for your homeowner's insurance seems like it's too much to do and an unnecessary burden - however, it's a vital step to getting your insurance company's adjuster to process your insurance claim quickly and getting you compensation for your personal property.

Fire cash buyers will buy your house as is. If you just had a house fire or are partially in the process of rebuilding and you just want to sell it now, we'll buy it.

Having a Home Inventory Helps Your Insurance Agent Get an Actual Cash Value on Your Personal Belongings

To help you keep track of your belongings, most insurance companies offer personal property inventory tools and apps that allow you to fill out information about your belongings.

Fire damage and house fires cause significant monetary loss, and the replacement cost values of your items might be higher or lower than your actual purchase price of the item. To get the maximum settlement possible and speed up the recovery process, it's best to list as many items as you can with as much information as possible.

What an Insurance Company Will Look For on an Inventory List

Information that a homeowners insurance company might ask for about an item are the original purchase price, a receipt, photos of the items, and a brief description of what the item was. If you can't find a receipt, check with the department store that you purchased your item from or your bank statements.

How to Prepare Before a House Fire

To stay one step ahead of a fire loss, it's important to utilize the tools that your current insurance company or insurance agency has in place, like a price scanning app or inventory list.

You also should take the following steps.

- Take photos or videos of your possessions.

- Take photos in their original condition.

- Take photos with a ruler or tape measure to show size.

- Keep receipts for major purchases. This includes furniture, appliances, electronics, and other items that cost more than $100, like furniture and expensive household items.

Not having the right insurance coverage or not having enough information for your current home insurance after a fire is not a place you want to be in. For more helpful tips on dealing with a house fire, smoke damage, house burns, and your home insurance company, please follow along with our blog.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

We Buy Fire Damaged Houses

No Obligation Free & Easy Offer

Get Cash Offer

We will get back to you as soon as possible.

Please try again later.

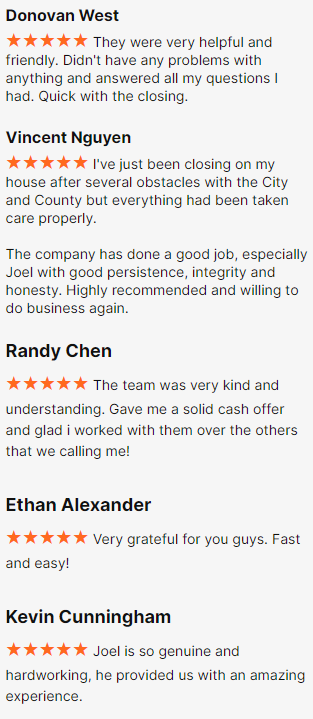

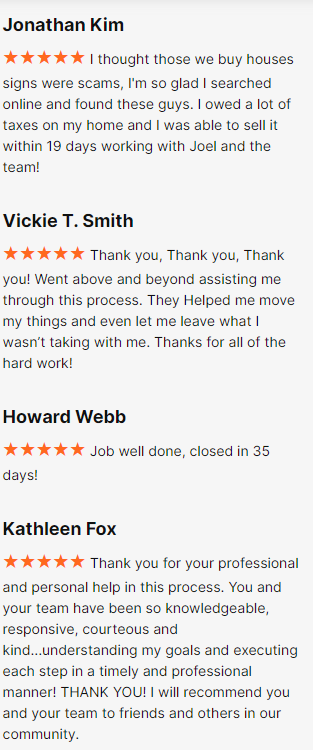

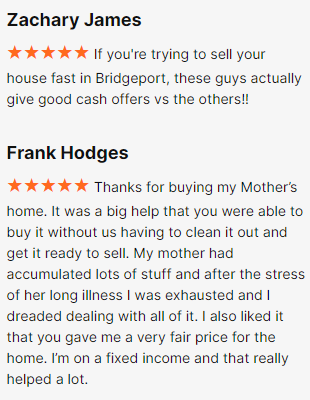

Happy Customers

All Rights Reserved | Fire Cash Buyers