Help After A House Fire No Insurance: Do This [Full Guide]

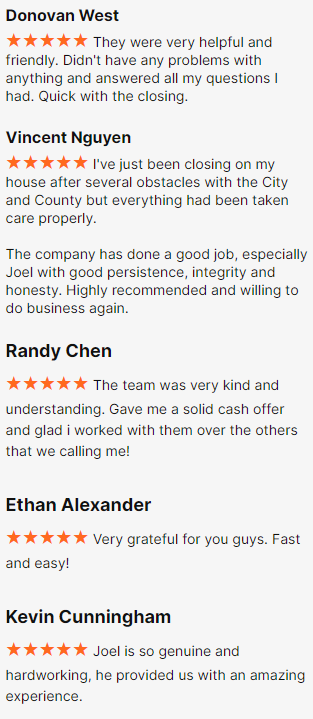

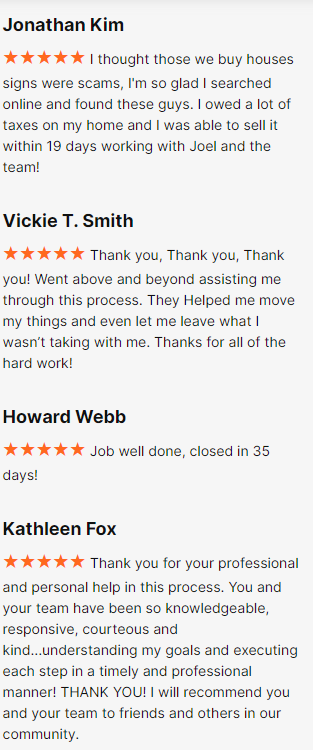

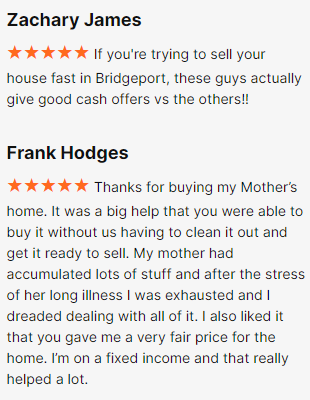

How We Can Help After a House Fire and No Insurance

t's undoubtedly traumatic for anyone, especially people, to experience a house fire, and not having the backing of an insurance policy to cover the damages and loss to your home and cover additional living expenses is a major problem. You may be asking yourself, "My house burned down, and I have no insurance". How am I going to cover my expenses and rebuild? The good news is there are a number of ways and things you can do to get your life back on track - not everyone needs to struggle with these problems.

If you're feeling overburdened with either demolition, city code violation fines, municipality fines, fire damage, water damage, smoke damage, mold damage, and the rising cost of labor to restore your home, you can sell your property as is. You can walk away, avoiding all the headaches with cash in your hand. Read our full guide on selling a fire-damaged home fast for cash, and consider filing a claim with your insurance company if you have one.

There are companies like ourselves that buy houses that have been affected by fire damage, which can be helpful if you are not in a position to handle the situation with your landlord.

What Happens If Your House Burns Down Without Insurance

If your house burns down and you have no insurance, you may be out of luck. If your mortgage company doesn't have insurance to cover the cost of the repairs, you could be responsible for paying for the repairs yourself. You may also be responsible for any damage to your neighbors' homes if the fire spreads. Even if you have insurance, it may not cover all of the costs associated with fire, so it's important to make sure you're properly protected for your own safety and those around you.

What To Do First After A House Fire

No one wants to experience a house fire, but it's important to be prepared if it does happen. Fires can occur at any time, and it's crucial to take care of the aftermath quickly. Make sure you have a plan in place to recover as soon as possible. After a fire, it is important to take the following steps:

1) Call the local fire department to request fire reports about when the fire happened.

2) Turn off the gas and water.

3) Pick up necessities (medications, clothes) and personal belongings from your home.

4) Take pets to a safe location.

5) Secure the home

6) Call a fire restoration company.

7) Contact your insurance company (renter's insurance) if you potentially have any

8) Let family and friends know you're okay.

Why Do You Need A Homeowners Insurance Policy?

There are a few reasons why homeowners insurance is important. It protects you from potential financial losses if your home is damaged or destroyed. It can also help cover your costs if you have to live elsewhere while your home is being repaired or rebuilt. And finally, homeowners.

If your home is damaged or destroyed, you can contact your insurance agent and file claims if you have insurance. Your homeowner's insurance will likely cover items destroyed in a house fire. If you have a replacement cost policy, you'll receive the actual cash value of your damaged items at settlement.

The type of insurance you need depends on the age of your home, your insurance deductible, and the amount of your mortgage. Seeking advice from a knowledgeable community can further help you make informed decisions regarding your home insurance, taking into account health and support for injuries, as well as expense coverage.

Incidentals Are Often Not Covered By Homeowner's Insurance Agency

Even if your homeowners' insurance covers fire damage, it doesn't necessarily cover everything. The National Association of Insurance Commissioners states that fire insurance policies typically don't pay for water damage from firefighting efforts, smoke damage to clothes or furniture you weren't insured about, or damage to items in your yard, even if it's someone else's fault. Knowing these exclusions can help reduce your stress and make the claims process smoother.

What Happens If Your House Burns Down And You Have No Insurance

If you're among the millions of homeowners in the United States who do not have insurance or liability protection, you may wonder what would happen if your house burned down. While the thought of such a tragedy is undoubtedly upsetting, it's important to be prepared for all eventualities. You need to know what would happen if your uninsured home went up in flames.

If your house burns down and you have no coverage, you should first contact your local authorities to file a police fire report. Once the report has been filed, you will need to contact your mortgage lender to let them know what has happened. If you have a mortgage on your home, the lender will require you to purchase a policy to protect your investment.

If you do not have a mortgage on your home, you will still need to contact your lender, as they may have a policy in place that requires you to maintain insurance on your property. In some cases, the lender may even require you to purchase a policy if you don't have a mortgage.

Once you have contacted your lender, you will need to start rebuilding your home. It can be a costly endeavor, especially if you do not have insurance to cover the cost of materials and labor. You may be able to get some financial assistance from the government or other organizations, but it is important to remember that these funds will likely be limited.

It is important to have insurance on your home to protect yourself from the financial consequences of a house fire. If you do not have a policy and your house burns down, you will likely be responsible for the cost of rebuilding your home. It can be a costly endeavor, so it is important to have a plan in place in case of such an emergency.

If you know a

family who's house burned down, we've made a list of things they'll need.

What Happens If You Can't Make Your Mortgage Payment

In the event of a house fire, insurance coverage may protect you from significant financial losses. However, if you can't make your mortgage payment, your lender may begin foreclosure. You will add any mortgage payments you've missed to your loan balance. If you have a 15-year fixed-rate mortgage, and your mortgage balance increases 0.5% for every 1% that your monthly payments are late, your balance may increase by 25% within one year. This makes having an insurance policy even more crucial to ensure your financial stability throughout the rebuilding process.

The longer you take to pay, the higher your balance will be when you stop payments. If your lender determines that you're not paying, your property will be auctioned off to the highest bidder, potentially resulting in an insurance claim. If you have any questions about this event, it's essential to ask your lender or legal professional about your rights and step-by-step guidance.

What To Do After a House Fire With No Insurance

You should contact your local authorities and mortgage lender. The authorities will file a police report, and the lender will require you to purchase coverage. If you don't have a mortgage, the lender may still require you to ensure your property.

You will also need to start rebuilding your home and may be eligible for some financial assistance from the government or other organizations. Having insurance on your home is the best way to protect yourself from the financial consequences of a house fire.

Did the fire start because of something you did?

If so, you might be able to take the person responsible to court. A lawyer can help you figure out what to do in this situation.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

Does The Government Give You Money If Your House Burns Down

The government does not give you financial aid if your house burns down. There are federal grant programs and the maximum payout from FEMA is about $32k. Your best option is to sell it to Fire Cash Buyers if you need cash now.

Where Do You Live If Your House Burns Down

A few options for where to live would be with family or friends temporarily. This isn't suitable or a viable long-term option for most. You could always sell your house as is, and use the cash to purchase another home or rent.

Who Can Help After a House Fire?

If your house burns down and you don't have a policy, you may be able to receive help from other sources, such as programs, charities, or benefits. Various organizations, like the Red Cross, Salvation Army, or United Way, can relieve most homeowners who have lost their homes, especially in areas hard hit by natural disasters.

The Red Cross is the fastest-acting source of aid in a disaster like a house fire. Their goal is to attend to your most immediate needs, including ensuring you have food, shelter, and clothing. That could mean providing you with a voucher for a many-day stay at a local hotel.

If you find yourself displaced by a disaster, don't worry – there are plenty of resources available to help you. You can always contact a local disaster relief agency to help you find temporary housing. Organizations like the Salvation Army can help connect you to finding temporary housing.

Check Out These Resources

- The Insurance Process After A House Fire

- Dealing With A Difficult Insurance Adjuster's After a House Fire

- The House Fire Insurance Payout

- House Fire Insurance Got Denied

- What You Can and Can't Do With The Extra Money From The Insurance Claim

- What Happens If You Have a House Fire But I Have No Insurance

- Average Cost Of Fire Insurance