How Much Is Fire Insurance For A House

If you own a house, you'll need to get fire insurance. There are many factors affecting how much fire insurance costs for a house, including the value of the home and its location. The type of coverage you choose also affects your premiums. Different types of fire insurance policies can help protect your home and its contents if damaged or destroyed by fire.

There are two main types of fire insurance policies: dwelling coverage and personal property coverage. Here is more information about both types and what to look for when you're getting quotes so that you can find the best deal possible on fire insurance for your house.

What Is A Fire Insurance Policy?

A fire insurance policy is a type of insurance that protects against fire damage to your home, business, and personal items. If a fire damages your property, the policy will pay for repairs or replacement costs up to your choice.

If you have a mortgage on your home, you may need to buy fire insurance to protect lenders from losses when homeowners default on their loans. However, if you rent, you don't need to buy fire insurance because renters' insurance cover fire damage (and other events) in your apartment or house.

What Is Dwelling Coverage?

Dwelling coverage is the most basic and important type of homeowner's insurance. It protects your home and its contents from fire, windstorms, theft, and other causes of loss.

The dwelling-coverage limit is the maximum amount your insurer will pay for physical damage to your home.

The coverage limit is typically expressed as a percentage of the replacement cost of your home (e.g., 80 percent). You may be able to increase this amount by buying optional coverage called replacement cost endorsements (RCX) or guaranteed replacement cost (GRC).

What is Personal Property Coverage?

Personal property coverage pays for the loss of your belongings that are not covered by your homeowners' policy, like your jewelry, art, and other collectibles, electronics, and clothing.

Typically, personal property coverage is offered in a dollar amount up to a specified limit. The amount of personal property coverage you need depends on the value of your possessions. You can buy additional coverage with a high deductible or purchase an endorsement to increase the limit without increasing your premium.

What is Actual Cash Value Coverage?

Actual cash value coverage is the amount of money your insurance company will pay to replace your damaged items.

Actual cash value (ACV) means the actual cost of replacement at a loss. It does not include any wear and tear depreciation, even if the item was only a few months old.

The higher your deductible, the lower your premium will be. However, you may want to consider increasing your deductible if you can afford it so that you are not paying out-of-pocket for damage to covered property or belongings.

What is Replacement Cost Coverage?

Replacement cost coverage is the most comprehensive type of insurance coverage. It will pay the full cost to rebuild your home if it is destroyed by a covered peril, including the cost of building materials, labor, and profit. This type of policy also includes coverage for additional living expenses if you have to live somewhere else while your home is being rebuilt.

Is Fire Insurance Included In Homeowners Insurance Coverage

Fire insurance is not included as part of a homeowners policy. But it's a good idea to add it because most states require it. If you don't have fire insurance, your insurer might not pay off your claim if your home burns down.

If you live in an area prone to wildfires or other natural disasters, you should also consider buying special coverage for those risks. For example, if you live in an area vulnerable to wildfires, consider adding a rider to your policy that pays off on claims if your home is destroyed by fire. If you've experienced a house fire from a wildfire we have a full guide on how to ask for donations.

What Does Fire Insurance Cover?

Fire insurance covers the cost of repairing or rebuilding your home after a fire destroys it. It also covers personal items inside your home at the time of the fire, such as furniture, clothing, and electronics. The amount of money you receive depends on how much was damaged or destroyed in the fire — not what it would cost to replace everything right now (such as new furniture) but only those damaged items in the fire itself.

Is Fire Insurance The Same As Home Insurance?

Fire insurance is different from homeowners insurance because it pays for a different set of damages caused by fire. Some homeowners' policies also include personal liability protection, which pays for bodily injury or property damage caused by someone who lives in your house (even if they don't live there all year round).

Also, some homeowners insurance policies cover damage to personal possessions caused by fire but not smoke damage from smoke detectors; other policies include coverage for both smoke alarms and smoke detectors as well as personal property losses caused by flood or water damage from burst pipes or other perils that cause water damage at your home.

WE CAN HELP WITH ANY SITUATION AND WE'RE READY TO GIVE YOU A FAIR CASH OFFER!

Enter Your Information Below it is Quick, Easy & Free!

Get Cash Offer

How Much Is Homeowners Insurance?

The average homeowners' insurance cost varies by state, but it's not just where you live that affects the price. The amount of coverage you buy also makes a difference. The average home insurance cost in the U.S. is $1,383 per year for a policy with $250,000 in coverage per claim and $100,000 in liability protection.

What Type Of Insurance Covers A Fire?

There are two main types of fire insurance: Dwelling coverage and contents coverage.

Dwelling coverage protects your home against loss or damage due to fire. It includes the structure, roof, foundation, and other permanent fixtures attached to the residence.

Contents coverage protects your belongings inside your home against loss or damage due to fire. It includes furniture, clothing, electronics, appliances, and other personal items you keep in your home.

Does Homeowners Insurance cover Wildfires?

Yes, wildfires are covered by homeowners insurance policies. However, homeowners need to know that their policy does not cover the entire cost of damage caused by a wildfire. If a wildfire damages your home or its contents, you should contact your insurance agent right away because there may be certain steps that must be taken to make sure your claim is paid in full.

How Does House Insurance Work With A Fire?

The great thing about home insurance is that it covers a wide range of eventualities. In the event of a fire, the insurer will pay for structural damage to your home and any possessions damaged or destroyed by the fire.

If there's no tangible damage to your property, you may have to claim on your contents-only policy instead. It will cover any valuable items inside your home if they're stolen or damaged by an intruder or natural disaster (such as a flood).

However, homes are often damaged by fire even if there's no physical damage. Insurers usually offer cover for this kind of indirect loss too. It might include loss of rent if you have to move out while repairs are carried out or temporary accommodation costs if you can't live in your property while it's being fixed up after a fire.

Does Insurance Cover Everything In A Fire?

No, insurance only covers the structure of your home and its contents. It doesn't cover any personal items or damage to other property, such as fences or landscaping. If your house is destroyed by fire and you don't have homeowners insurance, then all of those things will be out of luck when it comes to compensation.

How Much Insurance Do You Pay Per Month?

The cost of your fire insurance policy will vary depending on the type of coverage you need. For example, your lender may require you to purchase mortgage guaranty insurance (also known as MGA) if you have a mortgage.

This type of coverage protects the bank if one of its borrowers fails to make their monthly payments. The premium for this type of insurance is generally included in your monthly mortgage payment (though not always).

The cost of homeowners insurance policy can also vary based on how much coverage you're purchasing and where you live. For example, a homeowner living in an area prone to wildfires might want to consider purchasing additional coverage from an insurer specializing in providing fire protection — such as State Farm® — since they're likely better equipped to handle claims in high-risk areas.

Why Is Fire Insurance So Expensive?

Fire insurance policies are expensive because they cover events that occur very rarely and have a high cost when they occur. For example, if your house burns down and you don't have any coverage, you could lose everything you own - and then some!

The average homeowner's policy coverage limits the damage caused by fire to $60,000 per structure and $30,000 for personal property inside the structure. But these numbers are just averages; many home insurance policies have lower limits on both types of coverage.

Additionally, many insurance companies require that homeowners carry additional insurance against flooding or earthquakes to get the best rates on their fire policies.

What Are The Categories Typically Covered By Homeowners Insurance?

To help you figure out how much homeowners insurance you need, here are the six basic types of coverage that most home insurance companies provide:

- Dwelling Coverage: The structure itself and any attached structures such as garages or sheds

- Personal Property Coverage: Covers the loss or damage to your personal belongings, excluding automobiles and other motorized vehicles.

- Loss of use or additional living expenses coverage: This covers other people's property when your home's insured peril damages theirs.

- Medical Expenses Coverage: This covers medical expenses incurred after an accident at home not caused by a natural disaster or an insured peril.

- Liability Coverage: If someone is injured on your property, this will pay for their medical expenses and any legal costs associated with the accident for which you are liable.

- Medical payments Coverage (in some states): This coverage pays for medical expenses if you are injured on the job or elsewhere, and someone else is responsible for paying those expenses.

- Other structures coverage: If you have a detached garage or shed, this coverage will pay to repair or replace it if it was damaged by fire. The limit of insurance usually applies to all other structures on your property.

What Factors Affect The Cost Of Homeowners Insurance?

Home insurance costs vary widely, depending on where you live and the size and type of your home. Other factors that affect your premiums include:

The age of your home. Homes less than five years old usually pay lower premiums than older homes.

Whether you have a swimming pool or trampoline, which may increase your rate.

If you live in an area with a high crime rate, it could affect how much you pay for home insurance premiums.

Your deductible is another factor that can affect how much homeowners insurance costs. A high deductible can reduce the amount you pay each month, but it also means that you'll have to pay more out-of-pocket if there's an accident or loss in your home.

Importance Of Having Fire Insurance

Fire insurance is an important part of any home insurance policy. It can help reduce the chance of loss from fire, but it is also possible for homes to be damaged by other types of disasters. If you own a home, you need to take out fire insurance, but you will have to make several important choices to find the most suitable policy for your needs.

Addition Information You Should Know

- How Does Insurance Work After A House Fire

- How To Deal With A Difficult Insurance Adjuster After a House Fire

- All You Need to Know About Your House Fire Insurance Payout

- Can You Keep The Extra Money From The Insurance Claim

- What Can You Do If Your Fire Insurance Claim Gets Denied

- House Fire But I Have No Insurance

- Fire Insurance Claim Formula

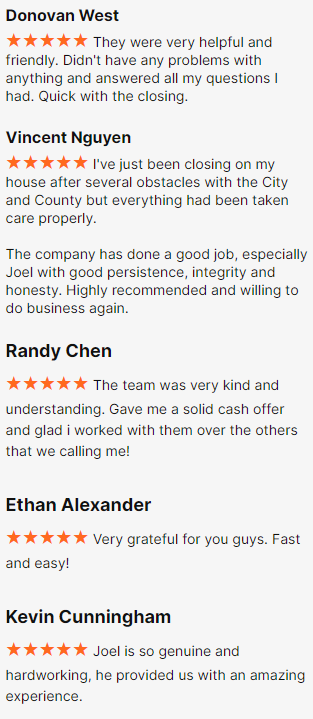

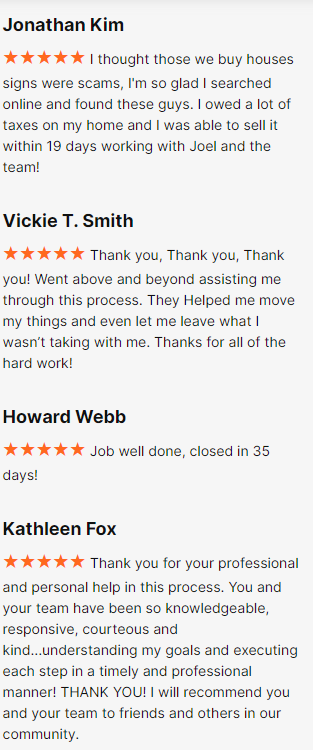

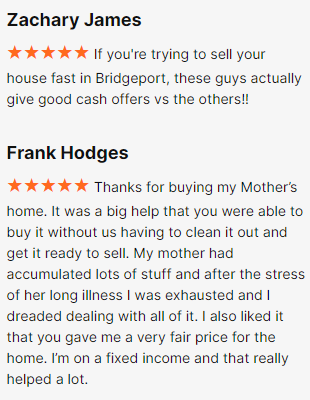

Happy Customers